Charging Board Tax Implications: What Every Aussie Parent Must Know

The “Full Nest” is the new normal. With rental vacancies at record lows, thousands of Aussie parents are welcoming adult children back home. But as

Whether big or small, Chipkie helps you formalise your loan, track repayments and more. No stress, no awkward reminders, just good karma.

Whether it’s a new car, paying off some bills, or getting that little leg up to start your own business, we all need a little help sometimes. Join the growing list of legends who are paying it forward with Chipkie.

With Chipkie, you can be confident you’ve ticked all the boxes, just in case things don’t go to plan. Sign up, set your loan details, sign your contract, and you are away. We’ll send reminders when payments are due and help you track your loan – no problems.

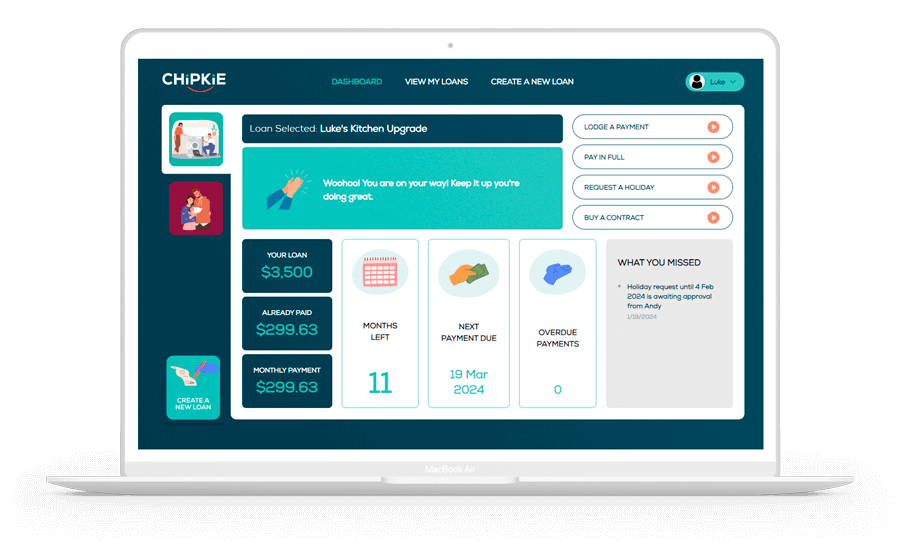

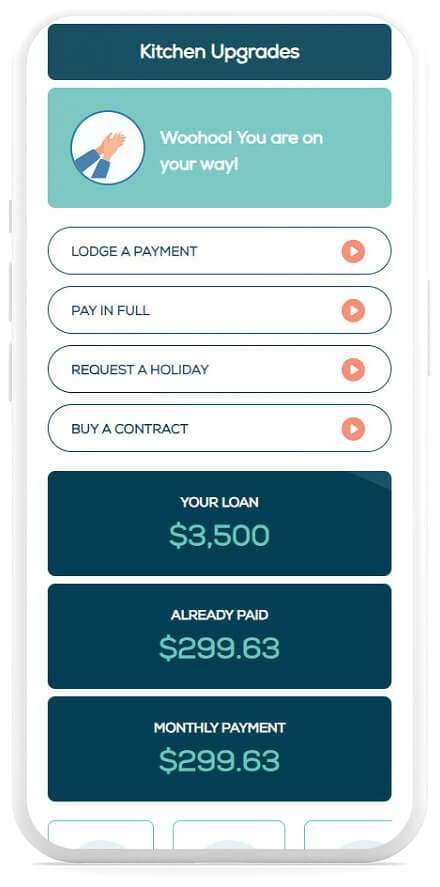

Our simple dashboard helps you track in a flash. Check what’s been paid, when payments are due, and how long you have to go.

Agree on your terms, and formalise the loan with a signed contract, just in case things don’t go to plan.

Let us take care of the reminders and requests with our automated reminders and updates.

With Chipkie, asking friends and family to support your dreams is easy, offering them peace of mind while you easily track what’s been paid back, and what’s to come. And best of all, it is free for all users. So what are you waiting for?

Browse the latest ideas and insights to help you make the most of your loans, plus the latest from the Chipkie newsroom.

The “Full Nest” is the new normal. With rental vacancies at record lows, thousands of Aussie parents are welcoming adult children back home. But as

In 2026, the “Australian Dream” has shifted. For many families, buying a separate home for aging parents or adult children is no longer financially viable.

Analysis of the 2025-26 Australian Taxation Framework The 2025-26 financial year represents a unique period in the Australian fiscal landscape: stable tax rates, revolutionary student