Executive Summary: The Dual Imperative of Formality and Preservation

The provision of financial assistance within Australian families and close friendships is a common practice, yet one fraught with significant legal, financial, and relational risk. The central requirement for mitigating these risks in Private Lending in Australia is adherence to the Dual Imperative: any capital advance must be executed with the formality and commerciality demanded by external regulators, specifically the Australian Taxation Office (ATO) and the Family Law courts, while simultaneously necessitating proactive relationship management. Reliance on verbal agreements or informal terms represents the single greatest point of transactional failure in Private Lending in Australia, risking the reclassification of the debt as a gift, loss of capital during divorce or insolvency, and potential tax liabilities for both parties. This report provides an exhaustive analysis of the necessary due diligence, documentation, security measures, and recovery pathways essential for protecting private capital in Australia.

I. Strategic Pre-Lending Assessment and Relationship Management

Before any funds are exchanged in Private Lending in Australia, the lender must conduct a rigorous assessment of transactional intent and personal capacity. Failure to establish clear parameters at this stage compromises subsequent legal enforceability and tax compliance.

1.1 The Crucial Distinction: Loan, Gift, or Contribution?

The initial and most critical determination is the objective intent behind the transfer of funds. A loan implies a legally binding expectation of repayment under specified terms; a gift is a non-repayable, gratuitous transfer of wealth. This distinction fundamentally dictates the treatment of the money in Australian law, particularly concerning taxation and family law property settlements.

The Problem of Presumption and Proof

In the context of familial arrangements, Australian common law historically operates under a presumption that agreements made between family members are not usually intended to create legal relations (intention to create legal relations). If documentation is absent or vague, courts are likely to uphold this presumption, often classifying the advance as a non-repayable gift or a non-recoverable contribution to the recipient’s finances, especially when the borrower faces external pressures such as divorce or insolvency.

This places an extremely high burden of proof upon the lender to demonstrate that the funds were advanced with a genuine expectation of repayment and enforceable terms. To successfully challenge the presumption of a gift in Private Lending in Australia, the arrangement must be evidenced by written documentation from its inception, consistent enforcement behavior, and commercial terms. If funds lack this formal structure, the lender loses the ability to claim the funds as a liability that reduces the divisible asset pool in a family law dispute, instead seeing the amount treated merely as a financial contribution subject to equitable division.

1.2 Risk Assessment: Financial Capacity and Relationship Strain

Lending money to a loved one introduces unique dynamics that commercial transactions do not face. The “Golden Rule” of Private Lending in Australia dictates that capital should only be advanced if the lender can financially afford the permanent loss of the principal amount. Statistical evidence suggests that a significant percentage of private loans remain unpaid, with non-repayment often leading to severe relational damage.

The lender must objectively evaluate the borrower’s general financial responsibility—determining whether the need for the loan stems from a temporary crisis or a chronic pattern of financial mismanagement. Furthermore, the lender must realistically assess the consequences of a default. If the loan is not repaid, the lender must decide whether they are willing to sue a family member or friend to enforce the debt, or whether the conflict and resentment caused by such action would be an unacceptable cost to the relationship. The emotional constraint of having to sue a relative often prevents the lender from initiating formal recovery procedures, thus legally invalidating the debt claim in the long term.

1.3 Estate Planning Integration

The loan agreement must clearly anticipate events such as the death of either the lender or the borrower. Terms should specify how the outstanding debt will be treated: whether it will be forgiven upon death, become immediately due, or transfer as a liability or asset to the respective estates. Integrating the loan documentation into both parties’ estate plans is a necessary measure to prevent the debt from becoming a source of complexity or dispute among beneficiaries.

II. Establishing the Legal Framework: The Formal Loan Agreement

The written loan contract is the single most effective tool for mitigating risk and satisfying external legal and tax requirements for Private Lending in Australia.

2.1 Why Formality is Non-Negotiable

While verbal loan contracts are technically binding in Australia, they are exponentially more difficult and time-consuming to legally enforce than a written agreement. Enforceability hinges on the lender’s ability to prove the precise terms—the principal sum, the repayment schedule, the interest rate, and the due date.

A formal written agreement is a legally defined contract between the parties. It provides clear documentation that the transaction is a genuine loan and not an unrecorded gift, which is vital for ATO compliance and bank requirements. Furthermore, Australian law sets a time limit of six years to start a court case to recover a debt. This period starts from when the money became owed, when the last repayment was made, or when the debt was last acknowledged in writing—whichever is latest. A written agreement establishes these critical commencement milestones.

Independent legal advice should be obtained by the lender before advancing money. A solicitor can draft a legally sound agreement, review security documentation, and prepare for necessary debt recovery actions, such as drafting Letters of Demand.

2.2 Exemption from the National Credit Code

Private Lending in Australia between individuals, particularly family members, is typically exempt from the stringent regulations of the National Consumer Credit Protection Act 2009 (NCCP) and the National Credit Code (NCC). The NCC applies where the lender is in the business of providing credit, charges a fee, and the credit is provided predominantly for personal, domestic, household, or residential investment purposes. Informal or casual loans between family members fall outside the policy intention of the NCCP, provided the lender is not operating a business of lending money.

2.3 Mandatory Clauses for an Australian Private Loan Agreement

A detailed agreement must include, at a minimum, the following clauses to protect the lender and ensure compliance:

- Party Identification and Principal Amount: Full names and addresses of both the lender and borrower, and the exact principal amount of the loan.

- Term and Repayment Schedule: The specified term (e.g., 12 months) or a specific maturity date, detailing the frequency and amount of repayments (e.g., consecutive monthly installments).

- Interest Rate: The specified rate of interest payable, whether fixed or variable, and the mechanism by which it accrues.

- Security and Collateral: Details of any asset used as security (collateral), such as real estate (requiring mortgage or caveat registration) or personal property (requiring PPSR registration).

- Events of Default and Remedies: Clear definitions of what constitutes a default (e.g., missed payment) and the precise enforcement terms available to the lender (e.g., acceleration of the principal amount or access to security).

- Acknowledgement of Legal Intent: Explicit clauses acknowledging that the advance is a loan, intended to be a genuine liability, and not a gift, addressing potential family law and tax issues.

The Vulnerability of Informal Transactions

The transaction method itself is critical. To maintain an unbroken audit trail and prove consistent behavior in Private Lending in Australia, lenders should overwhelmingly favor documented electronic transfers (EFT) over cash payments. If cash is unavoidable, a written receipt must be provided. A bank statement proving an EFT transfer, however, only proves the money moved; it does not inherently prove the intent to repay.

For the documentation to be robust, the transfer description (the memo) must reference the loan payment (e.g., “Loan Installment B. Smith”). This consistent paper trail is essential. If transfers are vague or payments stop, it becomes significantly easier for a financially pressured borrower (or their estranged spouse) to argue successfully that the funds were always intended as a gift, thereby undermining the written contract.

III. Navigating Australian Taxation Requirements (ATO Compliance)

For any loan that is formalised and exceeds casual amounts in Private Lending in Australia, strict ATO compliance is mandatory. The ATO’s primary concern is preventing Australian residents from disguising foreign income or taxable capital gains as untaxed loans or gifts from related entities. For domestic family loans, the risk is the reclassification of the transaction, potentially incurring significant income or capital gains tax liabilities and penalties.

3.1 The Taxation of Interest Income and Expense

Lender Obligations

Interest income derived from a private loan arrangement, even when lent to family members, is considered ordinary assessable income under section 6-5 of the Income Tax Assessment Act 1997 (ITAA 1997). The nature of the receipt remains ordinary income regardless of the relationship between the parties. The lender must declare the interest portion of any repayment received in their income tax return for the financial year in which the interest is received.

Borrower Deductions

The borrower’s ability to claim a deduction for interest expenses is strictly limited by the principle of nexus—the expense must relate to gaining assessable income. Interest expenses can only be claimed if the funds were used to acquire an income-producing asset (e.g., a rental property that is genuinely available for rent). Interest is not deductible if the loan principal was used for private purposes, such as purchasing a family car or paying down a mortgage on a primary residence.

3.2 ATO Scrutiny: The Criteria for a Genuine Loan

To successfully withstand ATO scrutiny, the transaction must meet the definition of a “genuine” loan, which requires adherence to three key criteria:

- Proper Documentation: The transaction’s characterization as a loan must be supported by comprehensive, clear documentation.

- Consistent Behaviour: The actions of both the lender and the borrower must align with the characterization of a loan (e.g., regular interest accrual, adherence to the repayment schedule, and active enforcement upon default).

- Independent Source (Contextual): The funds must originate from a source genuinely independent of the recipient (primarily relevant in international transactions, but supports commerciality domestically).

If the loan lacks proper documentation or if the parties’ behaviour is inconsistent with commercial expectations (e.g., non-enforcement of overdue payments), the ATO may determine that the transaction was, in substance, a non-genuine loan. This reclassification can lead to severe tax implications, including requiring the recipient to declare the value of the funds as income or triggering Capital Gains Tax (CGT) and Stamp Duty obligations if the transaction involved the transfer of property. The ATO has historically relied on the lack of documentation, texts, emails, or consistent repayment records to successfully challenge the status of unexplained bank deposits claimed as loans or gifts.

3.3 The Requirement for Commerciality: Interest Rate Benchmarking

While formal interest is not legally required for a private loan to exist, the charging, recording, and attempted collection of interest at a commercial rate serves a critical defensive function in satisfying ATO requirements for genuine intent and commerciality. The ATO considers arrangements undertaken on a commercial basis to be indicative of a genuine loan.

Although family loans are generally outside the scope of Division 7A of the ITAA 1936 (which governs loans from private companies), the Division 7A Benchmark Interest Rate provides the best objective standard for determining a market-comparable commercial interest rate. This rate is derived from the Reserve Bank of Australia’s (RBA) variable housing loans indicator rate.

| Table: ATO Division 7A Benchmark Interest Rates (Indicator for Commerciality) |

| Income Year Ended 30 June |

| 2025 (Projected) |

| 2024 |

| 2023 |

| 2022 |

IV. Managing Loss: Bad Debts, Defaults, and Forgiveness

The tax treatment of lost capital from a defaulted private loan is one of the most complex areas of Australian taxation, largely because the tax law rigorously restricts claiming tax deductions for lost private principal.

4.1 Tax Treatment of Unrecoverable Principal (Bad Debt)

For a lender who is not a professional money lender, the principal amount of a loan is deemed a capital asset—the legal right to repayment. Generally, the lender is not entitled to a revenue deduction for the principal amount because the money was not lent in the ordinary course of business.

Claiming a Capital Loss (CGT Event C2)

If the debt becomes genuinely unrecoverable, the lender may be entitled to claim a capital loss under the Capital Gains Tax (CGT) regime, specifically via CGT Event C2.

CGT Event C2 occurs when the ownership of an intangible CGT asset (the debt/right of repayment) ends by way of redemption, surrender, or it becoming irrecoverable at law. This event happens when the loan is formally determined to be worthless, such as through a formal settlement deed, or upon the formal winding up or deregistration of the borrower company. Whatever portion of the bad debt principal cannot be recovered can be recognized as a capital loss.

Crucially, a capital loss can only be used to offset current or future capital gains; it cannot be offset against ordinary assessable income, such as salary or wages.

The Critical Limitation: Private Use Assets

The greatest risk for a non-commercial lender is that the capital loss may be deemed a “personal use asset” loss, which is not allowable under the CGT regime.

The tax authority determines whether the loan was entered into for the primary purpose of deriving assessable income. If the loan is zero-interest or lacks consistent commercial enforcement, the ATO is more likely to classify the funds as a purely private advancement between related parties. If the transaction is deemed private in nature, the entire principal loss is irrecoverable for tax purposes. Therefore, charging, recording, and attempting to enforce commercial interest is a defensive mechanism, vital not just for generating assessable income, but for establishing the necessary commercial purpose to secure the future possibility of claiming a capital loss upon default.

4.2 Tax Treatment of Unpaid Interest and Debt Forgiveness

Unpaid Interest

If a lender has accounted for interest on an accruals basis (i.e., included the interest in their assessable income before receiving it), and that interest subsequently becomes unrecoverable, the lender may claim a deduction for that interest component as a bad debt under revenue provisions.

Debt Forgiveness

If a lender formally waives or forgives the debt, this triggers the debt forgiveness rules. For truly personal loans between family members that are not related to carrying on a business, the strict commercial debt forgiveness rules (Division 245) may not apply. However, for the borrower, forgiveness of a commercial debt results in the loss of certain tax benefits (e.g., carried forward losses or reduced cost bases of CGT assets). It is essential to understand that writing off a debt as “bad” (to claim a tax loss) has different consequences than formally forgiving it.

4.3 Mandatory Record Keeping

To support any claim for interest income, deductions, or capital losses, the lender must meticulously adhere to Australian record-keeping requirements. All records, including the written agreement, bank statements demonstrating fund transfers and repayments, and documentation proving the debt became bad, must be kept for at least five years after the transaction is completed. Given that capital loss claims may be carried forward indefinitely, documents relevant to the original capital cost basis may need to be retained much longer.

V. Securing the Lender’s Interest (Priority and Protection)

A formal loan agreement is insufficient if the borrower becomes insolvent or separates from a partner. Security measures ensure the lender retains priority over other creditors or the estranged spouse in Private Lending in Australia.

5.1 The Family Law Imperative: Protecting Capital in Separation

During the division of property following the separation of married or de facto couples, the court scrutinizes all advances from family members.

If the advanced money is formally and genuinely recognized as a loan, the outstanding balance is treated as a liability of the relationship, reducing the total asset pool available for division. The amount is repaid from the pool before assets are split.

If the advance is deemed a gift or an informal contribution, the money is included in the divisible asset pool and treated as a contribution by the party whose parents provided the funds. This contribution is then factored into the court’s overall assessment of a “just and equitable” division, meaning the amount is not recovered dollar-for-dollar by the lender’s relative.

Because the consequences are severe, the Family Court applies a “very robust approach” to assessing claims of liability, especially non-commercial loans between related parties. If the arrangement lacks formal commercial terms, is not consistently enforced, or arose informally, the court may view it as a “soft loan” intended to artificially deplete the asset pool during settlement negotiations. Proper documentation is therefore a mandatory shield against the risks inherent in family breakdown.

5.2 Real Property Security: Mortgages and Caveats

If the loan is used to purchase or finance property, the lender should secure their position against the real estate.

Mortgages and Caveats

A lender can register a written loan agreement with the relevant State Land Registry Services (e.g., NSW LRS) as a mortgage or a caveat. A caveat is a statutory injunction that warns all parties of an existing legal interest attached to the property title. Lodging a caveat prevents the registered owner from taking unilateral actions, such as selling the property, transferring the title, or using the property as collateral for other loans, without first addressing the caveator’s interest.

Legal advice is imperative before registering a caveat or mortgage. The lender must possess a clear, legally justifiable interest in the land arising from the loan agreement to support the caveat.

The Timing of Security Registration

Security measures must be implemented contemporaneously with the loan dispersal. Delaying the registration of a caveat until a relationship breakdown is already occurring may lead to suspicion that the security was created solely to defeat the property claim of an an estranged spouse. The ability to claim security successfully is strongly influenced by establishing the interest early, reflecting the true commercial nature of the transaction from the start.

5.3 Personal Property Security (PPSR)

For loans secured against movable or tangible personal property (e.g., high-value equipment, vehicles, or business assets), the lender must register their security interest on the Personal Property Securities Register (PPSR).

PPSR registration is a formal announcement to all of Australia that the lender holds a specific legal right over the borrower’s property. This action is essential for protecting the capital against insolvency. Registration “cements priority,” ensuring the lender stands at the front of the queue if the borrower enters bankruptcy or liquidation. Without timely PPSR registration, the lender’s security interest is generally unenforceable against a liquidator or bankruptcy trustee, placing the capital at severe risk. The process requires establishing a PPSR account and registering the security interest defined in a General Security Agreement (GSA).

VI. Dispute Resolution and Formal Debt Recovery

When a default occurs, the lender must follow a staged and escalating process, balancing the preservation of the relationship with the necessity of recovering capital.

6.1 Informal Resolution: Negotiation and Mediation

The initial response to a missed payment should prioritize informal negotiation and clear communication of expectations. The lender should attempt to resolve the dispute through discussion, potentially offering alternatives such as renegotiated payment plans, assistance with budgeting, or referral to financial education resources.

For disputes arising from family breakdown, formal Family Dispute Resolution (FDR), often referred to as family mediation, is a highly effective and frequently mandatory precursor to litigation. FDR utilizes an accredited practitioner to help separated families resolve financial arrangements, property division, and maintenance issues.

6.2 Formal Debt Recovery Pathways

If negotiation and mediation fail, the lender must be prepared to escalate to formal debt recovery, recognizing that this action may permanently damage the relationship.

Stage 1: Letter of Demand

The first formal step is to instruct a lawyer to draft and serve a formal Letter of Demand. This letter formally requests repayment, cites the relevant loan agreement, quantifies the outstanding amount, and sets a clear, final deadline. A lawyer-drafted demand letter provides maximum legal impact and demonstrates the lender’s readiness for litigation.

Stage 2: Initiating Court Proceedings

If the demand is ignored, the lender can initiate a court case to enforce the debt. The appropriate jurisdiction (e.g., Small Claims or Local Court) depends on the monetary limits set by the state or territory. For debts exceeding 5,000 AUD, engaging a debt recovery lawyer is strongly recommended due to the strict rules and complexity of court procedures and the necessity of drafting claims correctly.

A successful court judgment confirms the debt and allows the lender to pursue enforcement actions, such as seeking garnishment orders or seizing assets. It also has the ancillary effect of potentially appearing on the debtor’s credit rating, impacting their future ability to secure commercial finance. The lender must understand that timely legal action is essential; consistent non-enforcement over time makes the debt difficult, if not impossible, to recover and undermines the claim of genuine legal intent.

VII. Detailed Analysis and Precautionary Summary

Synthesizing the Interconnected Risks of Private Lending in Australia

The analysis of Australian law governing private lending reveals a series of interconnected risks that necessitate a highly cautious and formal approach. The perceived simplicity of lending to family members contrasts sharply with the strict evidential requirements imposed by regulators and courts.

The Indispensability of Commercial Terms for Tax Protection

The standard of documentation utilized by a private lender must satisfy the highest bar set by the ATO, focusing on the intent to generate assessable income, not merely the basic requirements of contract law. A loan may be technically valid with zero interest, but the absence of commercial interest strongly suggests a non-income generating, private purpose to the ATO. This vulnerability directly impacts the lender’s financial recovery options: if the loan is reclassified as private, the ATO is likely to deny any attempt to claim the lost principal as a capital loss via CGT Event C2. Thus, charging, recording, and collecting a commercial rate of interest is not merely a revenue goal, but a fundamental tax defense mechanism against the denial of loss deductibility in Private Lending in Australia.

The Enforcement Barrier as the Primary Threat to Capital

For most private lenders, the greatest threat to capital recovery is not the contractual invalidity of the loan, but the emotional and relational unwillingness to enforce the collection procedures. Australian debt recovery law requires timely action, adherence to the six-year statute of limitations, and the demonstration of consistent enforcement behavior. Emotional constraints inevitably delay or prevent the necessary formal steps, such as issuing a Letter of Demand or initiating court action. This hesitation, while emotionally understandable, is legally fatal to the debt claim in the long run, especially when facing external challenges like bankruptcy or divorce proceedings where evidence of non-enforcement is used to invalidate the debt.

The Low Expectation of Capital Loss Deductibility

The average private lender must operate under the assumption that a defaulted principal amount cannot be written off as a revenue deduction against their ordinary income (such as salary). Tax law limits non-professional money lenders to claiming only a capital loss (CGT Event C2). This loss can only offset capital gains, and is further subject to being completely negated if the ATO successfully argues the loan was a “personal use asset” and lacked an income-deriving purpose.

The Critical Timing of Security Registration

The efficacy of protective security measures is determined by the timing of their registration. Whether utilizing a caveat over property or registering a security interest on the PPSR for personal assets, these actions must be executed contemporaneously with the dispersal of the loan funds. Delaying registration until the borrower faces insolvency or separation means a commercial creditor who registered first will take priority. Moreover, lodging a caveat only when a relationship breakdown is imminent invites judicial scrutiny, risking the perception that the security was created purely to defeat the estranged spouse’s property claim.

Conclusions and Actionable Recommendations

To minimize financial and relational harm, Private Lending in Australia must be viewed as a high-risk fiduciary exercise requiring disciplined adherence to commercial and legal protocols.

- Mandatory Formalisation and Independent Advice: Every private advance must be underpinned by a comprehensive, written loan agreement drafted by a solicitor and executed with the benefit of independent legal advice for the lender.

- Commerciality as a Tax Defense: Charge, record, and actively enforce commercial interest (benchmarked against ATO Division 7A rates) and document all repayments via electronic transfer. This action is essential to satisfy the ATO criteria for a “genuine” loan and preserve the limited option of claiming a capital loss upon default.

- Prioritise and Register Security Immediately: Where feasible, secure the loan against assets and register the security interest (Caveat for real estate; PPSR for personal property) at the precise time the loan funds are transferred to ensure priority against external creditors and marital claims.

- Adopt a Precautionary Financial Stance: Only commit capital that the lender is financially and emotionally prepared to lose entirely. Accept that initiating formal enforcement, if necessary for recovery, will likely cost the relationship.

- Maintain Permanent Records: Retain copies of the executed contract, bank statements, and any evidence of enforcement attempts well beyond the standard five-year period, as these records may be necessary for future estate administration or long-term capital loss calculations.

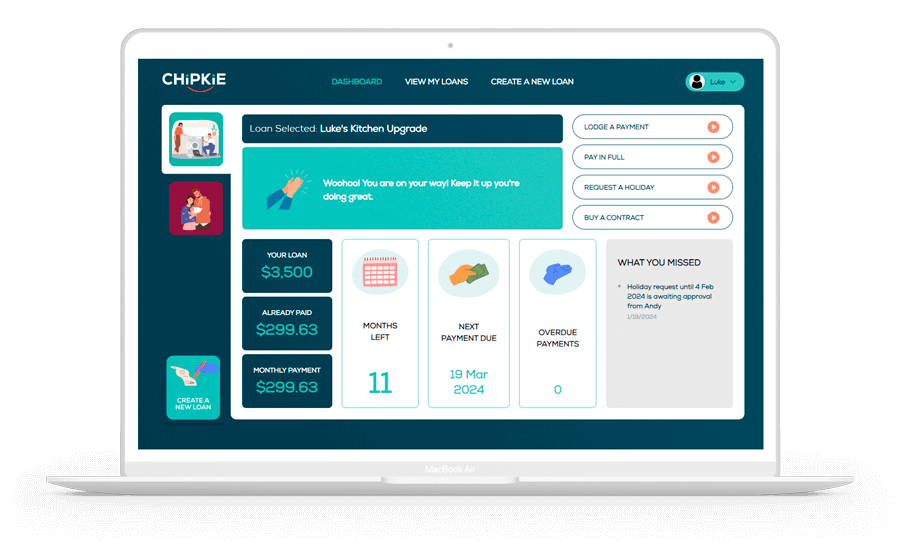

Final Word: Formalising Your Private Lending in Australia with Chipkie

The single greatest step in risk mitigation for Private Lending in Australia is eliminating the presumption of a gift by using a legally sound, digitally tracked contract. Chipkie specializes in turning informal family and friend advances into enforceable private loans. By providing tailored, compliant loan agreements that satisfy the ATO’s requirements for documentation and establish clear enforcement terms, Chipkie ensures your generosity is protected by law. Our platform removes the awkwardness of manual tracking and provides the transparency, certainty, and audit trail required to defend the loan’s status against tax authorities, divorce courts, and estate disputes, ultimately safeguarding both your capital and your most important relationships.