Analysis of the 2025-26 Australian Taxation Framework

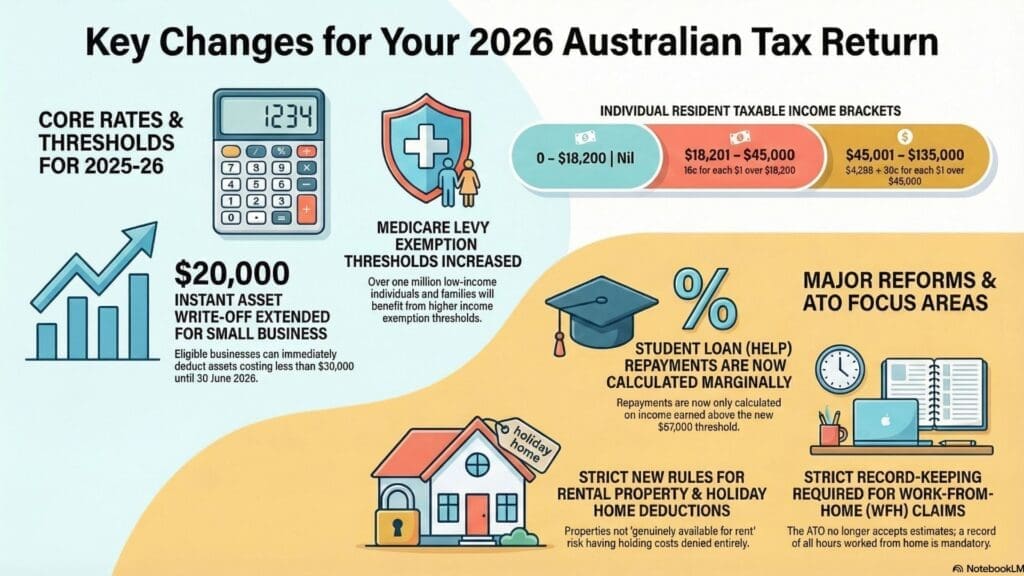

The 2025-26 financial year represents a unique period in the Australian fiscal landscape: stable tax rates, revolutionary student loan reforms, and the highest level of ATO data scrutiny in history.

Navigating this environment requires more than just a checklist; it requires a robust 2026 tax guide. While the “Stage 3” cuts of the previous year have consolidated, the compliance environment has tightened significantly. With the ATO bolstered by federal funding for the Shadow Economy Compliance Program, the era of “reasonable estimates” is over. It has been replaced by a demand for verifiable data.

This guide provides an exhaustive analysis of the structural changes, claimable entitlements, and strategic imperatives you need to maximise your tax return for the 2026 season. By understanding these new rules now, you can stop leaving money on the table and ensure your refund is as healthy as possible.

1. Personal Income Tax: Rates & Thresholds

A key component of any 2026 tax guide is understanding your marginal rate. While future tax cuts for the lowest marginal tier (dropping to 15%) are slated for July 2026, they do not apply to your 2026 tax return. For this year, we operate under the stabilised five-tier progressive structure.

Resident Individual Tax Rates (2025-26)

Note: These rates exclude the 2% Medicare Levy.

| Taxable Income Range | Tax Payable |

| $0 – $18,200 | Nil |

| $18,201 – $45,000 | 16c for each $1 over $18,200 |

| $45,001 – $135,000 | $4,288 + 30c for each $1 over $45,000 |

| $135,001 – $190,000 | $31,288 + 37c for each $1 over $135,000 |

| $190,001 and over | $51,638 + 45c for each $1 over $190,000 |

The “Super” Effect on Taxable Income

While the tax rates are static, your effective tax burden may shift due to the Superannuation Guarantee (SG) rising to 12% on 1 July 2025.

- Strategy: For employees on “total remuneration” packages, this increase in super contributions reduces your gross taxable income. This provides a marginal tax saving by lowering the amount of salary subject to the 30% or 37% marginal rates.

2. The Medicare Levy & Surcharge

No 2026 tax guide is complete without addressing the Medicare levy. The standard levy remains at 2% of taxable income, but crucially, low-income thresholds have been adjusted to protect vulnerable taxpayers.

Low-Income Thresholds (2025-26)

| Category | Full Exemption Threshold | Reduced Levy (Phase-out) |

| Singles | $27,222 | $27,223 – $34,027 |

| Families (No Kids) | $45,907 | $45,908 – $57,383 |

| Seniors (Single) | $43,020 | $43,021 – $53,775 |

| Seniors (Family) | $59,886 | $59,887 – $74,857 |

| Note: For families, the threshold increases by $4,216 for each dependent child. |

Strategic Management of the Surcharge (MLS)

High-income earners without private hospital cover face the Medicare Levy Surcharge (MLS). For 2025-26, thresholds have been indexed to Average Weekly Ordinary Time Earnings (AWOTE), offering slight relief from “surcharge creep.”

Income for MLS Purposes: Be aware that “Income for MLS” is broader than taxable income. It includes Reportable Fringe Benefits, Reportable Super Contributions, and Total Net Investment Losses (e.g., negative gearing). You cannot use rental losses to hide from the MLS.

| Tier | Single Threshold | Family Threshold | Rate |

| Base Tier | ≤ $101,000 | ≤ $202,000 | 0.0% |

| Tier 1 | $101,001 – $118,000 | $202,001 – $236,000 | 1.0% |

| Tier 2 | $118,001 – $158,000 | $236,001 – $316,000 | 1.25% |

| Tier 3 | ≥ $158,001 | ≥ $316,001 | 1.5% |

- Chipkie Insight: Often, the cost of a basic hospital policy with a maximum excess ($750 singles / $1,500 families) is lower than the 1-1.5% surcharge liability. Do the math.

3. Structural Reform: HELP Debt Repayments

The 2025-26 income year marks the end of the “cliff-edge” repayment system for student loans. Following the 20% debt reduction (June 2025), the government has introduced a Marginal Repayment System.

Previously, crossing a threshold meant paying a percentage on your entire income. From 1 July 2025, you only repay a percentage of the income above the threshold.

| Repayment Income | Calculation |

| $0 – $67,000 | Nil |

| $67,001 – $125,000 | 15c for each $1 over $67,000 |

| $125,001 – $179,285 | $8,700 + 17c for each $1 over $125,000 |

| $179,286 and over | 10% of total repayment income |

- Example: A graduate earning $75,000 previously paid ~$3,000. Under the new system, they pay 15% of the $8,000 excess—totaling just $1,200. That is a cash-flow win of $1,800.

4. Work-Related Deductions: The “Golden Rules”

The ATO is aggressively targeting “double-dipping.” This section of our 2026 tax guide details exactly what you can claim. To claim, you must satisfy the three golden rules:

- You spent the money yourself.

- It is directly related to earning income.

- You have a record (receipt) to prove it.

Working From Home (WFH)

You have two choices. Estimates and “4-week representative diaries” are no longer accepted for the fixed rate method.

Option A: The Fixed Rate Method (70 cents/hour)

- Covers: Energy, Phone usage, Internet, Stationery, Consumables.

- The Trap: If you claim this, you cannot claim a separate phone or internet bill. Even calls made “out and about” are covered by the 70 cents.

- What else you can claim: You can still claim separate depreciation for assets (laptops, chairs) and repairs.

Option B: The Actual Cost Method

- Requires a dedicated home office area.

- Allows you to claim the work-related portion of actual bills (cleaning, heating/cooling, phone/internet based on logs).

- Best for: High utility costs or heavy home-based business use.

The $300 Immediate Deduction & “Splitting” Strategy

Assets costing $300 or less can be claimed immediately (if used >50% for work).

- Strategic Split: If a couple buys a $500 laptop jointly (50/50 ownership), each person’s cost is $250. Both can claim an immediate deduction of $250 (work-use portion), whereas a single owner would have to depreciate the $500 over several years.

- Utility Split: Shared internet/electricity bills can be apportioned. Even if the bill is in one name, if the other person contributes and has WFH logs, they can claim their share.

Vehicle Expenses (88 cents/km)

The rate is 88 cents per km for 2025-26.

- Includes: Fuel, insurance, maintenance, and depreciation.

- Limit: 5,000km per car (Diary required).

- Logbook Method: Required for claims >5,000km (12-week logbook valid for 5 years).

- Warning: “Private” travel (home to work commute) is strictly non-deductible unless you are an itinerant worker or carrying bulky tools.

5. Property Investors: The “Leisure Facility” Risk

The most critical warning in this 2026 tax guide concerns Draft Ruling TR 2025/D1. The ATO is aggressively targeting holiday homes and short-stays.

The Risk

If your property is not “genuinely available for rent” during peak periods (school holidays), or is priced above market rates to deter bookings, the ATO may classify it as a “Leisure Facility.”

- Consequence: Most holding costs (interest, rates, insurance) can be denied entirely.

Apportionment for Short-Stays (Airbnb)

If you rent out a room, you can only deduct expenses for the days the room is actually tenanted. Days where the room is listed as “available” but empty are now treated as private use days.

Documentation Checklist:

- Booking calendars (showing no private block-outs in peak times).

- Advertising logs (proving market rates).

- Rejection logs (proving you didn’t unreasonably refuse guests).

6. Small Business & The Sharing Economy

$20,000 Instant Asset Write-Off (IAWO)

Extended to 30 June 2026 for businesses with turnover <$10m.

- “Installed for Use”: Buying an asset on June 29 isn’t enough; it must be installed/ready for use by June 30.

- Per-Asset Basis: You can buy three separate $15,000 machines and write off all $45,000 instantly.

- Assets >$20k: Must go into the depreciation pool (15% Year 1 / 30% thereafter).

Payday Super

Prepare now: From 1 July 2026, employers must pay super at the same time as wages. The 2025-26 year is your final chance to adjust cash flow away from the quarterly payment cycle.

Sharing Economy Reporting

Platforms (Uber, Airtasker, Car Next Door) now report your income directly to the ATO. You must report Gross Income and then deduct the platform fees/commissions. Failing to report this will trigger an automatic data-match flag.

7. Advanced Minimization Strategies

Superannuation: The $30,000 Cap

The concessional contribution cap is $30,000 for 2025-26.

- “Catch-Up” Rule: If your balance is under $500k, you can use unused caps from the previous 5 years. Critical: Unused caps from 2020/21 expire on 30 June 2026. Use them or lose them.

Prepayment of Expenses (12-Month Rule)

Pay next year’s professional subscriptions or income protection insurance in June 2026. If the service period is <12 months, you can claim the full deduction in the current return.

- Note: Only the “salary replacement” portion of Income Protection premiums is deductible. Capital/Trauma portions are not.

8. The 2026 ATO Hitlist (Red Flags)

Avoid these triggers mentioned in every serious 2026 tax guide to stay off the audit radar:

- Occupation Benchmarks: Claims significantly higher than the average for your job title trigger automated reviews.

- Double Dipping: Claiming the 70c WFH rate plus a separate mobile phone bill.

- Crypto Omissions: The ATO receives data from exchanges. Selling one coin to buy another is a taxable “disposal event.”

- Division 7A: Private company owners borrowing company cash without a formal loan agreement.

- TPAR Discrepancies: Contractors earning less than what was reported about them by builders/couriers via the Taxable Payments Reporting System.

9. Video Summary

If you prefer to watch vs read we have a vidoe summary below:

Conclusion

The 2026 tax guide advice is clear: success this season is defined by specific deadlines (IAWO 30 June), strict substantiation (WFH logs), and new opportunities (HELP debt marginal rates). By aligning your records with these rules now, you can confidently maximise your refund while staying compliant.

Next Step: Are your WFH logs up to date? Download the ATO myDeductions tool or check your Chipkie loan records to ensure every dollar is accounted for.

Disclaimer: This content is for general informational purposes only and does not constitute professional legal, tax, or financial advice. Chipkie does not take into account your personal circumstances or objectives. You should consider whether the information is appropriate for your needs and, where appropriate, seek professional advice from a financial adviser or lawyer.