As financial transactions move entirely online, so too have the risks. For high-value transactions like family loans, the greatest threat is no longer a simple default, but sophisticated identity fraud—where a scammer intercepts funds, or worse, uses a stolen identity to execute a fraudulent loan agreement in a family member’s name.

Protecting a family loan requires more than a signature; it requires proving that the person signing the contract is who they claim to be. The latest advancements in Digital Identity and Biometrics are providing the necessary layers of security to fight back. By securely verifying the identity of both the lender and the borrower digitally, families can ensure their financial support is safe, legitimate, and legally sound, preventing theft before it ever occurs.

The Three Phases of Digital Security in a Loan Agreement

The process of securing a digital loan involves multiple checkpoints designed to replace the vulnerability of an in-person, paper-based transaction with the certainty of digital verification.

1. Identity Verification (The “Who”)

This initial phase confirms that the person requesting the loan is a real, live individual and the legitimate owner of their identity documents.

- Document Verification Service (DVS): This Australian government system allows providers to check if key identifying documents (like a driver’s licence or passport) are valid and match the records held by the issuing agency.

- Facial Recognition and Liveness Detection: To defeat ‘deepfakes’ or a scammer holding up a photo, modern systems incorporate biometric technology. This requires the user to take a live selfie, which is compared to the photo on their ID. ‘Liveness’ detection verifies that the user is physically present, often by prompting a subtle action like blinking or turning their head.

2. Multi-Factor Authentication (MFA) (The “Access”)

MFA is critical for ensuring only the legitimate user can access and sign the final agreement.

- Beyond Passwords: MFA requires at least two forms of verification (e.g., a password and a one-time code sent to a trusted mobile phone). This simple step drastically reduces the chance of a hacker accessing the digital agreement even if they steal the password.

- The Audit Trail: Every step of the MFA process creates a non-repudiable audit trail, proving when and how the identity was confirmed, which is vital evidence in case of a dispute.

3. Digital Signing (The “Agreement”)

A digital signature is legally binding in Australia, but only if the verification process behind it is robust.

- Encrypted Contracts: The signed agreement is encrypted and stored securely. Any tampering after the signature is instantly detectable, making the contract immutable.

- Time Stamping: The digital contract is marked with a secure, server-generated timestamp that proves the date and time of the signing, which is essential for establishing when the debt legally commenced.

Beyond Security: The Privacy Advantage

While security focuses on keeping fraudsters out, the Digital Identity and Biometrics framework also enhances privacy by managing who gets to see your sensitive documents.

- No Document Storage: Modern verification (like that used in Australia’s government Digital ID system) often works by verifying your identity with the issuing body (e.g., the RTA) without needing to store or keep copies of your driver’s licence or passport. This reduces the risk of sensitive data being compromised in a breach.

- Consent and Control: The process puts the user in control, requiring explicit consent for any data sharing, which is a key consumer trend in 2025.

The Family Loan Security Checklist

Before finalising any large family transfer, ensure your platform or process adheres to these security non-negotiables:

- Written Loan Agreement: The foundation must always be a contract, not a handshake.

- Facial Biometric Verification: Require live facial recognition against the ID document to confirm the borrower is the real person.

- Encrypted Signing Environment: The platform used for signing must provide legal certainty and immutable evidence of the signature. This is the critical step that separates a formal P2L agreement from a risky P2P transfer.

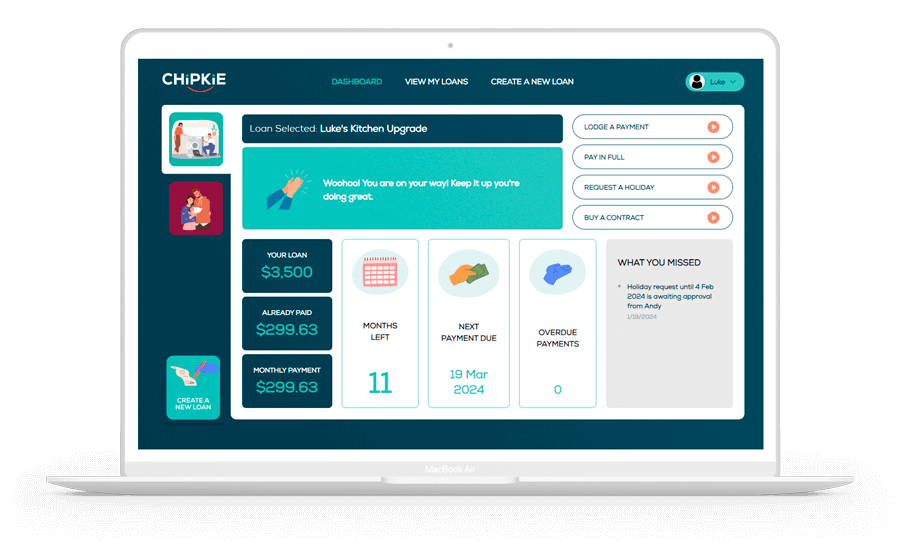

- Repayment Tracking: Use a platform that tracks repayments with a detailed log. This provides a clear, tamper-proof record for tax authorities or legal disputes. This detailed record is vital for managing Family Loan Tax Implications.

Ignoring these steps turns the convenience of a digital loan into a high-risk scenario, potentially making the family a target for sophisticated identity theft, where money is transferred and a debt created, all without the true borrower’s knowledge.

🛡️ Secure Your Generosity with Chipkie’s Digital Identity and Biometrics Framework

The risk of identity fraud is too great to entrust large family loans to informal processes. Chipkie is purpose-built to embed the highest security standards into the simple act of lending to a loved one. We integrate the necessary tools to leverage Digital Identity and Biometrics verification, ensuring that the person signing the contract is who they say they are. By providing legally sound, digitally-secured contracts with rigorous verification and transparent visual tracking, Chipkie adds layers of safety, certainty, and transparency to your family support. Protect your money from scams and your relationships from risk by formalising your next loan with Chipkie.