The dangers of Payday Lending – In today’s fast-paced world, financial emergencies can arise anytime. Whether it’s unexpected car repairs, medical bills, or any other sudden expense. These situations can leave people feeling overwhelmed and desperate for a quick solution. Payday loans, often advertised as a convenient lifeline, promise immediate cash with minimal requirements. However, before considering this option, understanding the potential risks and exploring alternatives is crucial so you don’t get caught out with more than you bargained for.

Understanding Payday Loans

Payday loans are short-term loans that people can obtain by providing proof of income and a post-dated check. The loan amount is typically a percentage of the borrower’s next paycheck. This type of loan is appealing because it doesn’t require a credit check or collateral, making it seemingly accessible to individuals with poor credit scores or limited assets.

The process of obtaining a payday loan is relatively simple. Borrowers visit a payday lending store or apply online, providing proof of income, identification, and a post-dated cheque. Upon approval, the borrower receives the requested cash amount. The loan is usually due in full within a short period, often two weeks, and includes the loan amount plus fees and interest.

The allure of payday loans lies in their convenience and speed. Unlike traditional loans that may take days or weeks to process, payday loans provide immediate financial relief. This quick accessibility can be alluring, especially when individuals are facing urgent expenses.

The Hidden Dangers of Payday Lending

While payday lending may seem attractive, it’s important to note that the simplicity of the process can sometimes lead to unintended consequences. With the ease of obtaining a payday loan, borrowers may find themselves trapped in a cycle of debt. The short repayment period and high interest rates can make it difficult for individuals to repay the loan in full, leading to a need for additional loans to cover the original loan.

Furthermore, payday loans often come with high fees and interest rates, making them an expensive form of borrowing. They are also not a long-term solution to financial problems.

Additionally, payday loans have faced criticism for targeting vulnerable individuals who may need help understanding the terms and conditions of the loan. Some argue that payday lenders take advantage of individuals in desperate situations, charging exorbitant fees and interest rates that can trap borrowers in a cycle of debt

Consider the dangers of payday lending, borrowers should explore alternatives, such as budgeting, seeking assistance from family and friends, or exploring low-interest loan options, before paying for payday loans.

Payday Lending’s High Interest Rates and Fees

Payday loans are notorious for their exorbitant interest rates and fees, which adds to the dangers of payday lending. These fees can range from $15 to $30 for every $100 borrowed, making the effective annual percentage rate (APR) reach triple digits in some cases. This high cost of borrowing can easily trap individuals in a cycle of debt.

Imagine you’re in a tough financial situation, struggling to make ends meet. You decide to take out a payday loan to cover your immediate expenses. The lender promises quick and easy access to cash, but what they don’t tell you is the hefty price you’ll pay for this convenience.

As you sign the loan agreement, you notice the fine print stating the interest rate and fees. The numbers seem staggering, but you’re desperate for the money, so you proceed. Little do you know that these seemingly innocent digits will soon become the chains that bind you to a never-ending cycle of debt.

With each passing day, the interest on your payday loan accumulates. The high APR means that even a small loan can quickly balloon into a substantial amount. As the due date approaches, you realize that you don’t have enough funds to repay the loan in full.

Dangers of Payday Lending – The Debt Trap

One of the most significant dangers with payday lending is the potential for a debt trap. Due to the short repayment period and high fees, individuals may find themselves unable to repay the loan in full by the due date. As a result, they often extend the loan by paying additional fees. This cycle can repeat itself, leading to a never-ending cycle of debt.

When the due date arrives, you’re faced with a difficult decision. You can either pay off the loan in full, including the exorbitant fees, or you can extend the loan by paying an additional fee. The latter option may seem more manageable in the short term, but it only prolongs your financial struggles.

As you extend the loan, the interest continues to accumulate, and the fees keep piling up. What started as a temporary solution to your financial woes has now become a vicious cycle. Each time you extend the loan, you’re digging yourself deeper into debt.

Before you know it, months have passed, and you’re still trapped in the payday loan cycle. You’re juggling multiple loans, each with its own set of fees and due dates. The stress and anxiety of constantly trying to keep up with the payments take a toll on your mental and emotional well-being.

Moreover, the debt trap created by payday loans can have long-lasting consequences. Your credit score may suffer, making it difficult to secure future loans or obtain favorable interest rates. The financial instability caused by payday loans can also impact your ability to cover essential expenses, such as rent, utilities, and groceries.

Legal Aspects of Payday Loans

Understanding the legal landscape surrounding payday loans is crucial to navigate the dangers of payday lending. While regulations and restrictions vary by jurisdiction, it’s essential to be aware of the rights and protections available to borrowers.

In an effort to protect consumers, many jurisdictions have implemented regulations to govern the payday loan industry. These regulations may include limits on interest rates, loan amounts, and repayment terms. Some jurisdictions may also require lenders to provide detailed information about fees and interest rates before approving a loan.

Borrowers have certain rights when dealing with payday lenders. These rights may include the right to cancel the loan within a specified period, the right to transparent and accurate information about fees and interest rates, and the right to dispute unfair lending practices.

Alternatives to Payday Loans

Considering the dangers of payday lending, exploring alternative options for obtaining quick cash is a wise decision. Here are a few alternatives to consider:

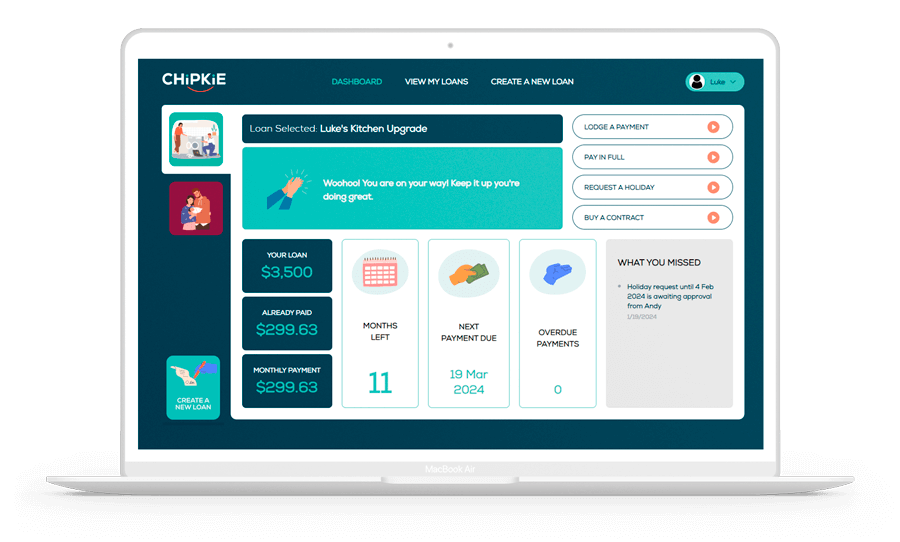

- Friends & Family Loans: The easiest and safest option is friends and family loans. 70% of people every years support thier friends and family with money lending. And while there is some trepidation, managing the loan delicately with the right communication and a formalised process can ensure a successful process and many positive benefits for the relationship. Find out why we created Chipkie here to manage friends and family loans, and start your loan process today.

- Personal Loans: Applying for a personal loan from a traditional financial institution may be a more affordable option. Personal loans usually offer lower interest rates and longer repayment periods, making them more manageable in the long run.

- Credit Card Cash Advances: For individuals with a credit card, a cash advance may be a viable alternative. While credit card cash advances can also come with higher interest rates, they are often more favorable than payday loans’ exorbitant fees.

- Payment Plans with Creditors: If the financial emergency is related to existing debt, contacting creditors to negotiate a payment plan may be a preferable option. Many creditors are willing to work with individuals to establish manageable repayment terms.

In conclusion, while payday loans may provide quick cash in times of need, but the dangers of payday lending can jeopardize an individual’s financial well-being. Understanding these risks and exploring alternative options is essential to make informed financial decisions. Taking the time to analyze your situation and seek out alternatives can help prevent falling into the payday loan trap and set a path towards long-term financial stability.