Deciphering APR and APY: Your Guide to Financial Acronyms

Understanding the Lingo In the realm of finance, Difference between APR and APY might seem like mere jargon, but they play pivotal roles. Whether you’re taking out a loan, investing, or just trying to manage your finances, grasping these terms can significantly impact your financial decisions.

Main Takeaways:

- Both APR and APY gauge interest, but they factor in different elements.

- APR often makes loans appear more affordable, while APY amplifies the allure of an investment.

- Grasping the nuances of APR and APY can lead to better financial choices.

Breaking Down APR APR, or annual percentage rate, provides insight into the interest and fees you’ll incur on borrowed funds. It’s a tool that lenders often use to present loan conditions. While it doesn’t consider compound interest like its counterpart, EAR, it does offer a clearer picture than mere simple interest.

Diving into APY Annual percentage yield, or APY, is your go-to metric when you’re dealing with interest accumulation, such as in savings or investment accounts. Unlike simple interest, APY factors in compound interest, which can significantly boost your earnings over time.

Difference between APR and APY APR vs. APY: Though they may seem interchangeable, APR and APY have distinct methods for assessing interest.

APR primarily focuses on:

- Interest rate

- Fees

- Various loan expenses

- Excludes compound interest

In contrast, APY considers:

- Interest rate

- Compound interest

- Excludes fees and other costs

Where You’ll Find APR and APY Typically, APR is associated with borrowing, while APY is linked to investing. However, there are exceptions.

APR is common in:

- Credit Cards

- Mortgages

- Various loans (student, auto, etc.)

APY is prevalent in:

- Savings accounts

- Money market accounts

- CDs

- Investment vehicles like mutual funds and ETFs

Why These Metrics Matter Without a grasp of APR and APY, you might overlook lucrative interest opportunities or incur higher fees. Recognizing the intricacies of loan repayments or potential investment growth can lead to wiser financial choices.

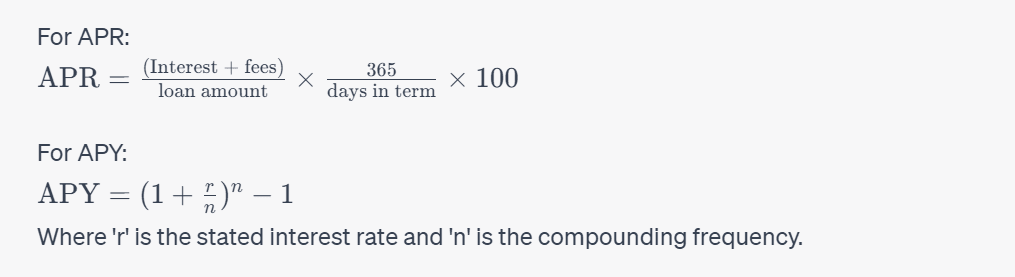

Crunching the Numbers: Calculating APR and APY While these formulas might not be the life of the party, they’re essential for making informed financial decisions.

EAR vs. APR EAR, or effective annual rate, is another essential interest metric. While APR gives a snapshot of borrowing costs, EAR delves into the compound interest that accumulates over time.

Credit Card APR: What’s Ideal? Given that a significant portion of adults own a credit card, understanding APR is crucial. As of late 2022, the average credit card APR was 19.04%. However, always consider other associated fees and potential future APRs.

Seeking the Best APY for Savings With the average APY for US savings accounts at 0.33% (as of Feb 2023), it’s wise to seek rates above this. High-yield savings accounts can offer over 2% APY, but they might come with risks and fees.

In Conclusion: APR and APY Unveiled While they might seem similar, APR and APY serve different purposes. They’re indispensable for anyone involved in finance. While APR can guide borrowers, it shouldn’t be the sole metric. APY, on the other hand, offers a glimpse into potential returns, helping investors strike a balance between risk and reward.