Introduction

Tired of rent disappearing into the void? Ready for a place to truly call your own? Buying your first home is a major milestone, both exciting and a little daunting. But with the right preparation, it’s incredibly rewarding. Our First Home Buyer Checklist is your roadmap to a smooth and financially savvy home-buying journey. Let’s dive into the essential steps!

How to Create a First Home Buyer Checklist for 2024

- When creating your checklist, start with in-depth market research on your desired location for affordability and availability of homes.

- Thoroughly assess your financial situation – savings, down payment, getting pre-approved for a mortgage, and calculating additional costs (closing fees, moving, etc.)

- Make a detailed list of must-have features for your home (bedrooms, location, amenities) to streamline your search.

- Get expert advice (real estate agents, financial advisors, home inspectors) for informed decisions throughout the process.

Important factors to consider when creating a first home buyer checklist

- Financial readiness: Check your credit score, save, research mortgages thoroughly, and consider ALL expenses (taxes, insurance, maintenance).

- Open Houses and Viewings: Get a feel for neighbourhoods and property types.

Customizing your first home buyer checklist to fit your needs

- Credit Check: This impacts your interest rates – make improvements if needed!

- Saving + Costs: A down payment is crucial, but don’t forget stamp duty, legal fees, etc.

- Government Help: Research grants and incentives specifically for first-time buyers.

- Pre-approval: Understands your borrowing power and shows sellers you’re serious.

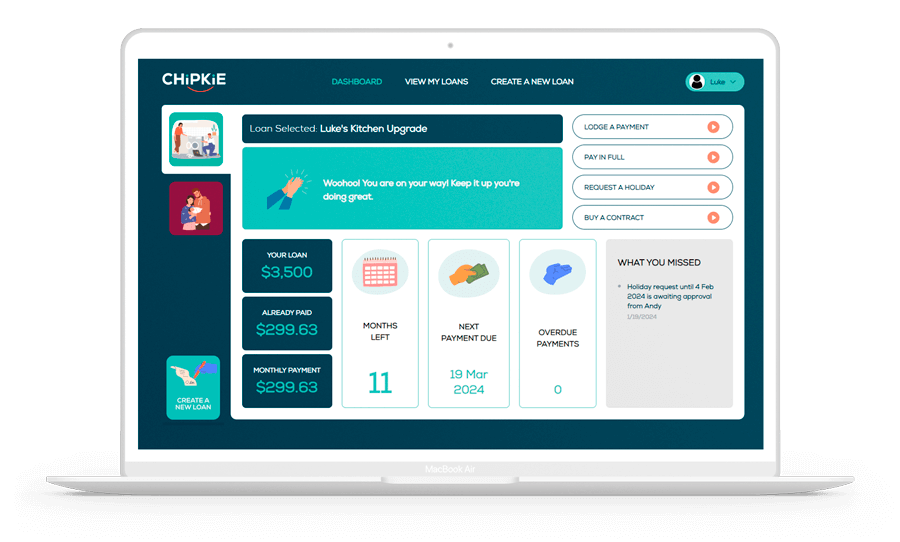

Utilizing technology to streamline your first home buyer checklist

- Budgeting Apps: Track income and expenses to see what you can afford.

- Mortgage Calculators: Estimate payments and play with different scenarios.

- Online Searches: Target properties based on your must-have list.

- Virtual Tours: Can help narrow down your choices before in-person visits.

Top Tips for Completing Your First Home Buyer Checklist in 2024

- Start with your credit score: Aim for the best possible rates and loan options.

- Research loan programs: Find the one that matches your goals and financial situation.

- Prioritize non-negotiables: Know what features your first home MUST have.

- Factor in ALL costs: Closing costs, inspections, and potential repairs need budgeting too.

Preparing for Inspections and Appraisals in the First Home Buyer Checklist

- Check your credit (again): It may be checked more than once during the process.

- Explore government programs: First-time buyer help can ease the financial burden.

- Budget beyond the down payment: Remember those often-overlooked extra costs.

- Pre-approval shows strength: It demonstrates to sellers that you’re a qualified buyer.

Navigating the Legal Aspects of the First Home Buyer Checklist

- Credit check (yes, again!): It’s essential to maintain good financial standing.

- Calculate your affordability: Determine down payment, mortgage payments, etc., within your budget.

- Thoroughly research mortgages: Find the perfect fit for your long-term goals.

- Don’t forget ADDITIONAL costs: Taxes, insurance, and maintenance add up!

Tips for Researching and Selecting Potential Properties

- Credit is crucial It impacts what you’ll qualify for.

- Determine your TOTAL budget: This factors in mortgage payments, taxes, insurance, etc.

- Compare mortgage lenders: Get the best rates for your situation.

- Consider extra costs: Home inspections, appraisals, moving expenses – budget for them all!

Organizing Your Finances for the First Home Buyer Checklist

- Credit check: You know the drill – maintain the best score possible!

- Explore grant options: These can significantly lessen the financial burden.

- Budget meticulously: Down payment, mortgage, closing fees, ongoing maintenance…plan for it all.

- Consider the bigger picture: Where does your new home fit in your overall lifestyle and goals?

Understanding the First Home Buyer Checklist Requirements

- Check your credit (again!): Strong scores improve your mortgage options.

- Calculate your affordability: Know your down payment potential and comfortable monthly payment range.

- Become a mortgage expert: Research different types and find the best fit for YOU.

- Budget beyond the basics: Property taxes, insurance, and maintenance add up quickly!

The Ultimate First Home Buyer Checklist for 2024

- Pre-approval + Budget: Start strong with financial clarity.

- Location Research: Find your ideal neighborhood and what’s realistically available.

- Government Help: Research grants/incentives – every dollar counts!

- Get advice: Real estate agents, conveyancers, and inspectors = your expert team.

Essential Documents for First Home Buyers

- Know your finances: Research mortgage options and get pre-approval if possible.

- Location matters: Consider the neighbourhood vibe and your lifestyle needs.

- Inspection is protection: A professional inspection uncovers potential issues.

Budgeting Tips for First Home Buyers

- Start with your credit score: Improvements can mean better loan terms.

- Save diligently: Your down payment is crucial, and bigger is better!

- Get mortgage savvy: Compare rates and programs to find the optimal fit.

- The true cost: Factor in home inspections, closing fees, and homeowners insurance.

Property Inspection Must-Dos for First Home Buyers

- Credit check time: Aim to maintain or improve your score during the process.

- What can you afford? Know your budget inside and out.

- Research, research! Understanding mortgages empowers you.

- Don’t forget the extras: Taxes, insurance, and maintenance impact your long-term affordability.

Understanding Mortgage Options for First Home Buyers

- Credit is king: It heavily impacts your rates and loan possibilities.

- Thorough research: Different mortgages suit different situations – find your match!

- Calculate EVERYTHING: Factor in taxes, insurance, etc., for your true cost of homeownership.

- Seek professional help: Get an inspection, it could save you thousands!

Navigating the Closing Process for First Home Buyers

- Credit check reminder: Maintain good standing all the way to closing.

- Affordability is KEY: Know your down payment and realistic monthly payments.

- Mortgage mastery: Choose the right type for your situation and goals.

- Budget for the end: Closing costs, taxes, insurance – have those funds in place!

1. Hone in on a location

- Credit counts Good scores = better mortgage options.

- Calculate carefully: Know your down payment, mortgage payments, and additional costs.

- Compare and contrast: Research different mortgage options for the best fit.

2. House or apartment?

- Credit check time: Good scores = better mortgage options.

- Think government help: Research grants or incentives for first-time buyers.

- Budget beyond the price tag: Factor in taxes, maintenance, and insurance.

- Pre-approval power: It shows sellers you’re serious AND establishes your budget.

3. Check whether the property has all the features you need

- Credit matters: It directly affects your loan terms and rates.

- Seek first-time buyer programs: These can reduce financial burdens.

- Pre-approval gives you an edge: Show sellers you have the means to buy.

- Total cost budgeting: Include taxes, insurance, maintenance, etc.

4. To build or to buy

- Credit score checkup: Lenders will be looking, so be prepared!

- Calculate the big picture: Know the TRUE cost of homeownership (taxes, insurance, etc.).

- Seek government assistance: First-time buyer programs can be a lifesaver.

- Pre-approval = power: Shows you’re financially ready and serious about buying.

5. Get your finances in order

- Check that credit score: Make it as good as possible for favourable mortgage terms.

- Research grants and assistance: Take advantage of any help available.

- Calculate your true budget: Include down payment, closing costs, and monthly payments.

- Pre-approval = smart move: It establishes your financial capacity and shows sellers you’re ready to buy.

6. Think about your investment return

- Budget foundation: Know what you can truly afford to spend.

- Mortgage matters: Research carefully for the best rates and terms.

- The long view: Factor in taxes, insurance, and maintenance to see the full cost.

- Pre-approval = confidence: It gives you a clear starting point to shop within your price range.

7. Get home loan pre-approval

- Check your credit (yes, again!) Higher scores mean better options and rates.

- Budget clarity: Pre-approval defines your spending limits.

- Research and compare: Find the mortgage that aligns with your financial goals.

- Seller advantage: Shows you’re a serious buyer, strengthening your negotiating position.

8. Get a building and pest inspection

- Credit check: It plays a role, even this far along.

- Seek government assistance: Some areas have programs to help with purchase costs.

- Meticulous budgeting: Ensures you’re financially prepared for the entire process.

- Checklist of must-haves: Prioritize features that are essential for your ideal home.

9. Figure out if you’ll need to shell out for repairs or renovations

- Credit scores still count: Maintain good standing for the best loan options.

- Calculate with care: Factor in down payment, closing costs, moving expenses, AND any immediate repairs/renovations.

- Compare mortgage lenders: Get the best interest rates and terms for your situation.

- Budget for the unexpected: Ensure you have reserves for potential surprises after purchase.

10. See if there’s room for price negotiation

- Credit check (you’re a pro at this now!): It remains an important factor with lenders.

- Know your budget limits: Stick to what you can afford, down payment AND monthly payments.

- Mortgage matters: Secure the best possible type and terms for your circumstances.

- The TOTAL cost: Be prepared for inspection fees, appraisals, homeowners insurance, etc.

11. Perform a title search

- Credit check routine: Make sure your score is in the best possible shape.

- Calculate your budget: Ensure you can comfortably manage the down payment, closing costs, etc.

- Mortgage mastery: Choose a loan type and lender that best suits your needs.

- Prioritize necessities: Keep your list of “must-have” features in mind during the search.

12. Get a conveyancer on board

- Credit check – the final time? It may be checked one last time before closing.

- Savings matter: Ensure you have sufficient funds for the down payment and closing costs.

- Explore grant programs: These could lessen your financial burden and boost your down payment.

- Pre-approval proves seriousness: It signals your financial readiness to sellers and conveyancers.

13. Sort out home and contents insurance

- Check your credit score (again): It can impact your insurance premiums.

- Calculate total monthly costs: Include mortgage payments, utilities, AND insurance in your budget.

- Seek first-time buyer programs: There may be help available to reduce your costs.

- Get an expert: A real estate agent can guide you, especially with your first home purchase.

What could your home loan repayments look like?

- Credit score matters: Aim for the highest score possible for the best interest rates.

- Your full budget: Factor in down payment, closing costs, and monthly mortgage payments.

- Seek government help: Research grants/incentives specifically designed for first-time buyers.

- Factor in EVERYTHING: Stamp duty, legal fees, home insurance… it all adds up!

Frequently Asked Questions

- What are the key steps in the process of buying my first home?

- Establishing your budget (down payment, closing costs, monthly mortgage)

- Researching loan options & government programs

- Creating a checklist of your desired home features

- Working with a reputable real estate agent

- What factors should I consider when choosing a location for my first home?

- Proximity to amenities (schools, shops, transport, healthcare)

- Neighbourhood safety, atmosphere, and potential development

- Commute to work and accessibility to transport

- Property market trends and potential for future value growth

- How can I determine how much I can afford to spend on my first home?

- Calculate monthly income vs. expenses for disposable income

- Consider additional costs: property taxes, insurance, maintenance

- Getting pre-approved for a mortgage gives you a realistic limit

- Lifestyle & long-term financial goals should also factor in

- What kind of assistance or incentives are available for first-time home buyers?

- Government programs (down payment assistance, low-interest loans, grants)

- Tax incentives or credits specific to first-time homeownership

- Financial institution programs with specialized mortgages and reduced fees

- Non-profit organizations providing guidance and resources

- What are some common mistakes to avoid as a first-time home buyer?

- Forgetting about additional costs beyond the house price

- Neglecting credit score and debt-to-income ratio maintenance

- Rushing the neighborhood research

- Not getting pre-approved before falling in love with a home

Conclusion

By following this checklist and taking advantage of the resources available, you’ll be well-positioned for a successful first home purchase. Ready to take the next step? Download our FREE printable ‘First Home Buyer Checklist’ for a handy, all-in-one reference to guide your journey. Let’s turn your homeownership dreams into reality!