Lending money to a loved one is a gesture filled with generosity and support. Whether you’re helping a child buy their first home, pay for education, or navigate a financial challenge – providing a helping hand is a wonderful instinct. However, like any financial transaction, it’s essential to formalise a family loan to protect both you and your loved one.

While trust is a cornerstone of any family relationship, money matters can become complex. A formal loan agreement helps prevent misunderstandings, offers legal protection, and allows for clarity and fairness across the board.

Here’s why a written agreement is essential:

- Unwavering Clarity: A formal agreement puts everything in writing: the loan amount, repayment schedule, interest rate (if any), and other important conditions. This eliminates the possibility of disagreements based on differing memories or verbal promises.

- Legal Enforceability: It’s hard to imagine taking a family member to court. However, a formal loan agreement is a legally binding document. In the unlikely event of a serious conflict, this provides a pathway to resolve the situation fairly.

- Understanding Tax Implications: Depending on the amount and circumstances of the loan, there might be tax implications for both parties. A formal agreement, ideally drawn up with the help of a financial or legal advisor, ensures everyone understands and complies with their tax obligations.

- Asset Protection: Life can throw curveballs. A formal loan agreement safeguards the money you’re lending – an act of love towards your children.

- Divorce: It helps protect the loaned amount as a debt, not a marital asset, in the unfortunate event of a divorce.

- Financial Hardships: If your child encounters financial difficulties, a formal loan agreement helps shield funds from creditors.

- Peace of Mind: Above all, formalizing a family loan provides both you and your loved one with peace of mind. Knowing that all terms are clearly understood and documented allows for a positive and supportive transaction, minimizing any awkwardness or future strain.

Additional Considerations:

- Secured vs. Unsecured: Secured loans are backed by an asset, like a house, while unsecured loans are not tied to collateral. Consult a professional to understand which option is right for your situation.

- Defaulting on Repayments: A formal agreement outlines consequences for missed or late payments. These could include interest and penalties, acting as a deterrent and upholding the terms of the loan.

The Importance of Professional Advice

Formalizing a family loan often requires legal or financial expertise. Consulting a lawyer or financial advisor can help ensure all necessary considerations are addressed:

- Fair Interest Rates: Prevent any misunderstanding of what qualifies as excessive or illegal interest.

- Legal Terms: Make sure the loan agreement is legally sound, including understanding the statute of limitations for recovering a debt in your region.

- Tax Considerations: Be fully aware of all tax implications that may apply.

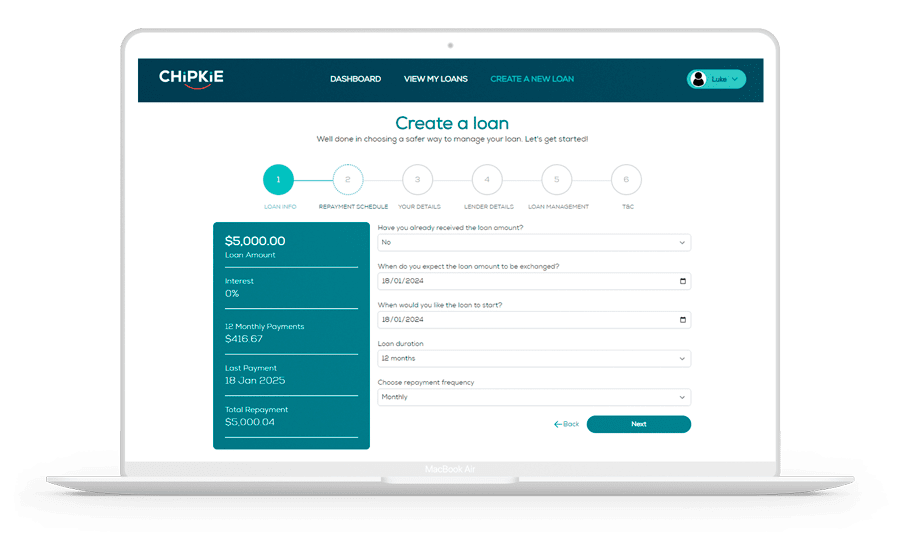

The Chipkie Way

At Chipkie, we believe in fostering positive and supportive lending experiences within families. Formal agreements, while seemingly strict, are actually a tool of empowerment. They allow you to help your loved ones with confidence, knowing that both your interests and the overall relationship are safeguarded.

While trust is the foundation of any family, formalizing loans is a way to ensure that financial generosity can continue for generations to come.