In today’s digital economy, we exchange money with friends and family hundreds of times a year. We split the dinner bill, send a birthday gift, or cover the cost of concert tickets with instant P2P Payments apps like PayID, PayPal, and others. These platforms are phenomenal tools for small, everyday transactions.

However, a fundamental confusion exists between an instant P2P Payment and a formal P2L (Peer-to-Loan) agreement. When the amount moves from $\$50$ for dinner to $\$5,000$ for a car or $\$50,000$ for a home deposit, relying on a simple, undocumented transfer becomes a serious legal and financial risk. The casual convenience that defines P2P Payments is precisely what makes them dangerously inadequate for significant family loans. Understanding the difference between P2P Payments vs P2L is non-negotiable for protecting both your finances and your relationships.

P2P Payments: The Architecture of Informality

P2P (Peer-to-Peer) payment apps are designed for speed, convenience, and consumption. Their architecture is built on the assumption that the money is being exchanged for a current good or service, or is a gift.

| Feature | P2P Payments (Instant Transfer Apps) | P2L (Formalised Lending Platforms) |

| Primary Function | Instant settlement of small, casual debt or gifts. | Creation of a legally enforceable debt over time. |

| Legal Status | An informal IOU. Undocumented and generally unenforceable in court. | A legally binding contract (promissory note) signed by both parties. |

| Recourse for Default | Awkward conversation, resentment, loss of friendship. | Formal legal steps to recover the debt, preserving the relationship. |

| Repayment Structure | One-off, lump sum, or manual, ad-hoc transfers. | Automated, scheduled instalments with clear principal/interest tracking. |

| ATO/Legal Clarity | High risk of being viewed as a “gift” during property settlements or estate division. | Clear documentation that the funds are a “loan” and an asset of the lender. |

The key takeaway is that P2P apps are built to execute a transfer, not to document an agreement. They lack the vital legal framework required to make a large debt enforceable.

The Three Major Risks of Using P2P for Big Loans

Moving large sums via an instant transfer app subjects the money to three areas of extreme risk that a formal P2L agreement eliminates:

1. The Loss of Recourse and Enforceability

When you send $\$10,000$ via an instant transfer app with a note that says “Loan for car,” you have technically just provided an undocumented gift. If the borrower defaults, the transfer app offers zero mechanism for recovery.

- Bank Perspective: Banks and courts will only recognise a debt if there is a signed agreement detailing the repayment terms, maturity date, and what constitutes a default. Your transfer history is not a contract.

- Result: The lender must either absorb the loss or initiate a costly, protracted legal fight that relies solely on circumstantial evidence (texts, emails), which is precisely the situation a written contract is designed to avoid.

2. Estate and Family Court Confusion

This is where the distinction between P2P Payments vs P2L is most severe. If the recipient of the funds goes through a divorce or the lending parent passes away, the money is at risk:

- Divorce: In the Family Court, an undocumented large transfer is typically deemed a non-repayable gift to the recipient, meaning the money is added to the marital asset pool to be divided. A formal P2L agreement, however, registers the money as a legitimate liability against the recipient, protecting the parents’ funds.

- Inheritance: Without a contract, the loan is not considered an enforceable asset of the estate. The borrowing sibling can quietly claim the money was a gift, leading to immense sibling squabbles disrupting the intended Fairness in Family Lending among the children.

3. The Tax Audit Scrutiny (The Gift Trap)

The ATO is well-aware of large P2P Payments flowing between family members. If you loan a significant sum and do not formalise the transaction, the funds could be mistakenly interpreted as a gift.

- Loan Clarity: A formal P2L agreement clearly sets the terms and intent, ensuring the money is treated as a debt.

- Repayment Proof: A formal agreement includes a structured repayment schedule. When you combine the formal contract with the automated repayment history, you create an undeniable audit trail that satisfies tax authorities. This clarity is especially critical when the funds are used for a family business loan.

The Modern Hybrid Solution: Separating Intent from Execution

The ideal financial support model requires leveraging both technologies:

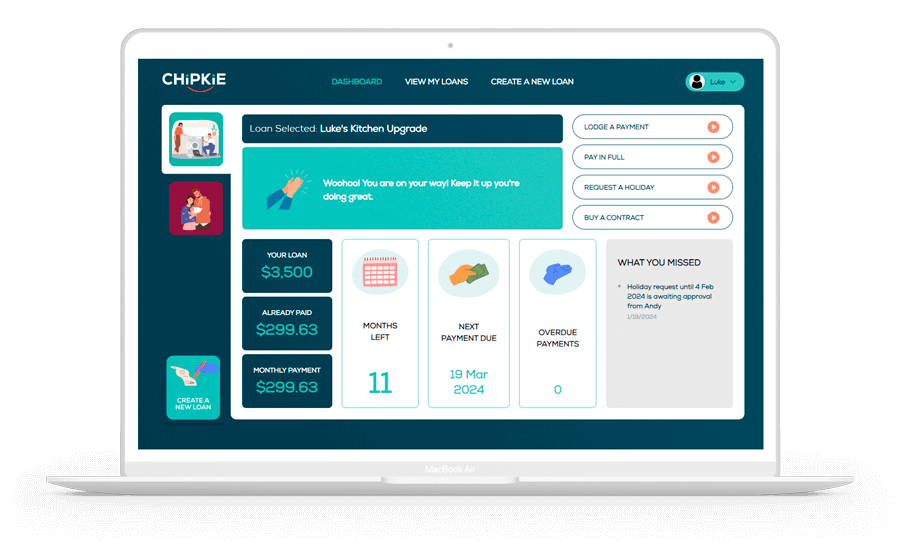

- Use P2L to Establish the Intent: Use a service like Chipkie to generate and sign a legally binding contract that formalises the principal, term, and repayment schedule. This defines the transaction as a loan (P2L).

- Use P2P Payments for Execution: Once the contract is in place, you can use instant transfer apps for the actual movement of the scheduled repayments. The documentation protects the money, while the app provides the convenience.

This two-step approach ensures that the legal and emotional integrity of your relationship is secured, while still enjoying the speed of digital finance.

🛡️ Move Beyond P2P Payments vs P2L Confusion with Chipkie

For loans that truly matter—those funding a future, like a home deposit, education, or business—the informality of P2P Payments is a dangerous liability. Chipkie removes this risk by specialising in the P2L model (Peer-to-Loan). We provide the rigorous legal documentation and structure necessary to formalise your loans between friends and family, adding safety, certainty, and transparency. Chipkie ensures your intentions are protected by law, offering clear repayment tracking and a professional audit trail. Don’t use a payment app built for $\$20$ coffees to secure a $\$20,000$ investment. Formalise your significant transfers with Chipkie and protect both your money and your relationships.