When it comes to growing your savings or planning your investments, understanding the concepts of simple interest vs compound interest is crucial. Both play pivotal roles in personal finance, influencing how your money grows over time. This blog post will demystify these two types of interest, outlining their differences, how they work, and when one might be more beneficial than the other.

What is Simple Interest?

Simple interest is, as its name suggests, the simpler of the two calculation methods. It is determined based on the principal amount alone, ignoring any interest previously earned. The formula for calculating simple interest is as follows:

Simple Interest = Principal × Rate × Time

Principal is the initial amount of money invested or loaned.

Rate is the annual interest rate.

Time is the period for which the money is lent or invested, typically represented in years.

For example, if you invest $1,000 (the principal) at an annual interest rate of 5% for 3 years, the interest you would earn each year is $50. After three years, the total interest earned would be $150.

What is Compound Interest?

Compound interest is often described as “interest on interest.” It not only applies to the principal amount but also on the accumulated interest over previous periods. This method can significantly increase the growth of your savings or investments, especially over longer periods. The formula to calculate compound interest is a bit more complex than that of simple interest:

A = P (1 + r/n)^(nt)

Where:

A is the future value of the investment/loan, including interest.

P is the principal amount.

r is the annual interest rate (decimal).

n is the number of times that interest is compounded per year.

t is the time the money is invested or borrowed for, in years.

Suppose you have the same $1,000 invested at an annual interest rate of 5%, compounded annually for 3 years. Using the compound interest formula, at the end of 3 years, you would have approximately $1,157.63. The difference from simple interest arises because in the second year, you earn interest on $1,050, and in the third year, on $1,102.50.

Key Differences

The fundamental difference between simple interest and compound interest lies in their calculation. Simple interest is straightforward, making it easy to calculate and predict. On the other hand, compound interest can significantly boost the growth of investments over time, thanks to the compounding effect. Compound interest is particularly beneficial in long-term investments.

Another key difference is where they are commonly applied. Simple interest is often used in short-term loans or investments. In contrast, compound interest is the foundation for most savings accounts, bonds, and long-term investment plans.

When to Choose Which?

Deciding between simple and compound interest often depends on the specifics of your financial situation and goals.

For short-term loans or investments, simple interest might be more favourable as it can result in lower payable or earnable interest.

For long-term investments, compound interest is generally preferred due to the potential for exponential growth over time.

Understanding both concepts allows you to make informed decisions that could either save you money or significantly increase your investment over time. It empowers you to plan better for your financial future, whether you’re saving for retirement, a major purchase, or simply looking to grow your wealth.

In conclusion, while simple interest may offer simplicity and predictability, compound interest offers the possibility of greater returns. Understanding and using these concepts effectively can be a powerful tool in your financial arsenal, enabling you to make the most of your money.

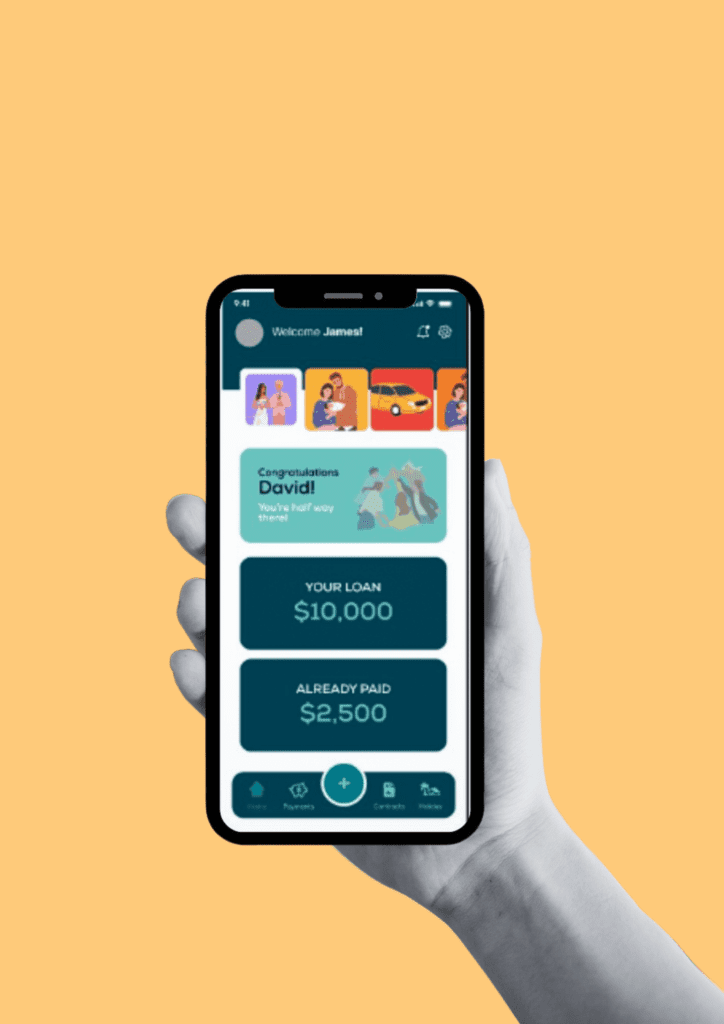

Thinking about borrowing or lending from friends or family, think Chipkie:

Rethink borrowing and lending. Chipkie transforms the way you manage loans between friends and family. Effortlessly create legal agreements, track payments, and set reminders – all while preserving relationships and protecting everyone involved. Experience the ease of secure, transparent lending, and empower your financial circle. Chipkie offers official protection, flexible repayment options, and even support for those rare moments of disagreement. Discover why Chipkie is the smarter way to lend.