Lending money to friends or family members in need is a common practice. However, it’s important to be aLending or borrowing money within the family is one of the most common financial arrangements in Australia. Whether you’re a parent funding a deposit or a sibling consolidating debt, the convenience is undeniable. However, the informality of these transactions often ignores the crucial role of the Australian Taxation Office (ATO). Understanding your Family Loan Tax Implications is essential because the ATO views any income generated from lending—even to loved ones—as potentially taxable.

The core distinction that determines your tax fate is simple: Is the transfer a legally documented loan or an undocumented gift? We break down the tax rules from the perspective of both the lender and the borrower, ensuring you stay compliant and avoid future penalties.

1. From the Lender’s Perspective: Is Interest Income Taxable?

For the lending party (the family member providing the funds), the key question is whether interest is being charged.

A. Loans with Interest (Taxable Income)

If you charge any rate of interest on the loan, that income is generally assessable income and must be declared on your annual tax return. This is non-negotiable.

- Rule: The interest is classified as ‘Income from Other Sources.’ It is added to your total income and taxed at your marginal tax rate.

- The Trap (Non-Enforcement): If your formal written agreement states you are charging 5% interest, but you fail to collect it, the ATO may still argue that the interest income was legally receivable and should have been declared. This highlights why compliance with the agreed-upon terms is vital for managing Family Loan Tax Implications.

B. Interest-Free Loans (Generally Tax-Neutral)

If the loan is genuinely interest-free, you don’t earn any income, so there are no tax implications for the lender.

- The Risk (The Gift Trap): However, if the loan is a large, interest-free sum used for a successful investment (like a rental property), and it lacks documentation or a repayment schedule, the ATO may scrutinize it. They could potentially argue that the transaction was a disguised form of early inheritance or unfranked dividend (if funding came from a family company/trust), although successfully doing so is complex. Properly documenting the principal amount and the zero interest rate is the best defense.

C. Capital Gains Tax (CGT) Risk on the Transfer

You typically do not pay CGT when you transfer cash. However, if the transaction is structured as gifting an asset—such as transferring shares or an investment property to a child as part of the loan—you may incur an immediate CGT liability based on the asset’s market value, even though you received no money. Read our comprehensive guide on avoiding the CGT Gift Trap here

2. From the Borrower’s Perspective: Is Interest Tax-Deductible?

For the borrowing party (the recipient of the funds), the principal amount of the loan is never considered taxable income. The focus is on whether the interest paid is a tax deduction.

A. Personal Use Loans (Not Deductible)

If the loan is used for personal expenses—such as a car purchase, a holiday, medical bills, or consolidating consumer debt—the interest paid is not tax-deductible.

- Example: If a sibling loans you $20,000 for a car, and you pay $1,000 in interest, that $1,000 cannot be claimed as a deduction.

B. Income-Generating Investment Loans (Potentially Deductible)

If the loan is used to acquire an asset that generates assessable income, the interest paid is generally tax-deductible.

- Common Examples: Funds used to purchase an investment property, capital injections into a new family business loan, or funds used to acquire income-producing shares.

- Meticulous Records Required: To claim this deduction, the borrower needs meticulously maintained records, including a formal loan agreement and proof of all interest payments. Without this documentation, the ATO can easily reject the deduction.

3. The Compliance Checklist: How to Win with the ATO

The ATO has made it clear that while they don’t regulate who you lend to, they will scrutinize how the transaction is executed to ensure tax compliance. To confidently manage your Family Loan Tax Implications, you must formalise the debt.

- Document Everything: Create a formal, written loan agreement signed by both parties. It must specify the principal amount, the repayment schedule, the interest rate (or lack thereof), and the term of the loan.

- Define the Intent: The contract must clearly state the purpose of the loan (e.g., “for the purchase of a residential investment property”) to support any subsequent interest deductions claimed by the borrower.

- Treat it Like a Business Deal: If you are charging interest, the lender must declare it, and the borrower must pay it. Your actual conduct must align with the written agreement to withstand ATO scrutiny.

- Avoid the Statute of Limitations Trap: In most Australian states, if a debt is undocumented or not acknowledged/repaid for six years, the Statute of Limitations can apply, making the debt legally unenforceable. Regular repayments tracked via a documented contract keep the debt active and valid.

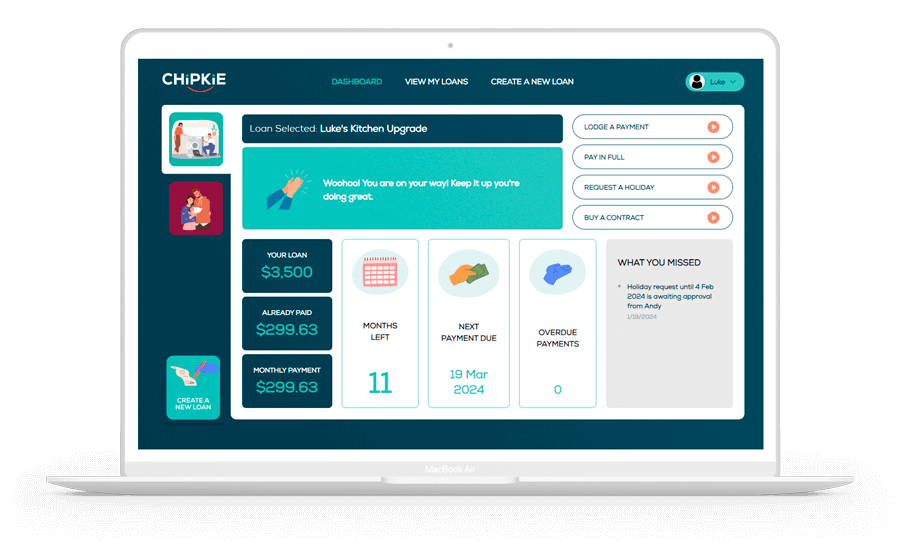

Ensure Family Loan Tax Implications Compliance with Chipkie

Managing the legal and tax obligations of family lending doesn’t need to be overwhelming. The complexity of Family Loan Tax Implications demands a solution that is both professional and easy to use. Chipkie removes the risk of informal lending by providing the rigorous structure and documentation required to satisfy the ATO and secure your family’s future. We ensure your transactions are backed by legally sound contracts, providing safety, certainty, and transparency. Chipkie gives you a clear audit trail of all principal and interest payments, visual tracking of the loan balance, and automated records, so you always have the proof needed to defend your tax position and protect your money.