Lending money to friends and family can be a great way to support loved ones, but it’s vital to do it right to avoid financial friction and maintain strong bonds. A personal loan agreement, also known as a How to Write a Loan Agreement, provides a clear roadmap, keeping everyone on the same page and minimizing awkwardness. Let’s break down how to create one in Australia.

Understanding Personal Loan Agreements

- What it is: A legally binding document that formalizes loan terms between individuals (not banks).

- Why it’s wise: Ensures clarity, sets expectations, and protects both borrower and lender.

- Enforceability: Can be upheld in Australian courts if disagreements arise.

What to Include: Step-by-Step

- Details, details!

- Full names and addresses of all involved

- Government-issued ID numbers may be requested for added verification

- Date of agreement, plus key milestones

- Core of the Matter

- Loan amount (the principal)

- Interest rate – ensure it adheres to Australian usuary laws

- Repayment plan: Include frequency (weekly, monthly, etc.), schedule, and total length.

- Late Payment Penalties: Detail associated fees or consequences.

- Security Matters

- Is the loan secured by an asset? If so, specify the asset, its value, and under what conditions the lender can take possession.

- Let’s Talk Legal

- Jurisdiction: Choose the Australian state where the agreement will be enforced. Be mindful of state-specific laws.

- Dispute Resolution: Outline steps for mediation in case of disagreement. This can save hefty legal costs.

- Additional Considerations (Tailor to Your Needs)

- Prepayment conditions: Can the borrower repay early, and will there be any penalties?

- Credit Checks: Lenders may request permission to verify the borrower’s income and creditworthiness.

- Severability and Entire Agreement clauses: These standard clauses protect the validity of the agreement in specific legal instances.

- Seal the Deal

- Signatures of all parties. A witness or notary can add a layer of legitimacy, though not mandatory.

Australian Law: Key Points

- Interest rate caps: Check the state-specific usuary laws to avoid charging an illegal rate.

- National Consumer Credit Protection Act (NCCP): This may apply if your loans become a regular business activity.

- Stamp duty: Some states might impose stamp duty on your agreement. Consult a professional for clarity.

Don’t Need a Law Degree: Tools to Help

Creating a personal loan agreement doesn’t have to be daunting. Here are some resources:

- Online Templates: Websites like LawDepot Australia ([invalid URL removed]) offer customizable templates.

- Legal Professionals: For complex loans or high amounts, consider getting legal advice to ensure your agreement is comprehensive.

Don’t Forget: Protect Your Relationship!

A written agreement brings peace of mind and can actually strengthen the bond between lender and borrower. Open, respectful communication during the process is just as important as the paperwork.

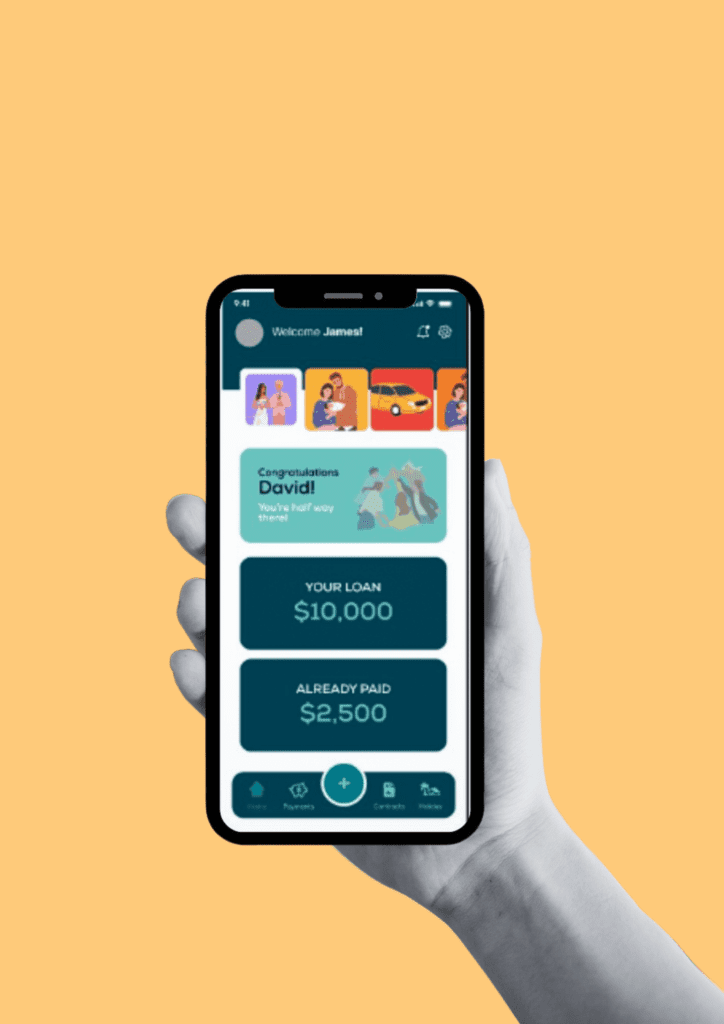

The Chipkie Benefit

Forget messy paperwork and potential legal headaches. With Chipkie, you can streamline the entire loan agreement process. Our intuitive platform guides you step-by-step to create legally-binding contracts in minutes – no lawyers needed! Secure electronic signatures add an extra layer of protection. But Chipkie’s value doesn’t end there: it helps manage the loan with effortless tracking, automated reminders, and flexible repayment options. And if disagreements arise, Chipkie even provides dispute resolution support. Take the stress out of personal loans and protect your relationships with Chipkie.