Payday loans have become a regular place to turn for many Australians needing a fast cash injection to bridge the gap until their next paycheck arrives or cover any unexpected expenses. While payday loans might seem convenient, however they often come with high fees and high-interest rates – trapping borrowers in an even longer cycle of debt. Fortunately, safer payday loan alternatives can help Aussies get the cash support they need without falling into financial hardship. Read on as we explore alternative options and provide valuable insights into managing personal finances responsibly.

The Pitfalls of Payday Loans

Before we delve into the alternatives, it’s important to understand why payday loans are generally considered risky borrowing. Payday loans are short-term loans that target low-income individuals who need immediate cash to cover expenses until their next payday. It might seem like a convenient solution, but most people will pay for the convenience with exorbitant interest rates, sometimes as high as 48%. This makes repayment challenging, especially for borrowers who are already struggling financially.

Moreover, relying on payday loans can negatively impact your credit score. If applying for a credit card or loan, providers will often review your credit history, and they may view your use of payday loans as a sign of financial instability. This could result in your credit application being rejected, making it even harder to access credit in the future.

Exploring Safer Payday Loan Alternatives

Luckily, there are several payday loan alternatives that can offer Aussies the quick money solutions they need, without the excessive interest terms and financial risks. These are:

No-Interest Loans:

Interest free loans are an excellent option for individuals who need to borrow small amounts for essential expenses. Certain banks typically offer these loans and are available to low-income households. They can be used to cover expenses such as medical care, education, or car repairs. The loan amount and eligibility criteria vary depending on the lender, but generally, these loans have no interest or fees, making them an affordable and responsible borrowing option.

Qualifying for an interest-free loan isn’t simple, with interest-free loans granted on precise criteria, such as having a low income, experiencing family or domestic violence, or holding a Health Care Card or Pension Card.

Centrelink Advance Payment:

You may be eligible for an advance payment if you receive Centrelink benefits. This allows you to receive a lump sum payment in advance, which can help cover unexpected expenses. The advance payment is then repaid in installments with a small interest. While it’s important to note that this is not a no-interest loan, the interest charged is generally lower than the rates associated with payday loans.

To request a Centrelink advance payment, you will need to contact Services Australia to find out more. This option can temporarily relieve those facing financial difficulties and help avoid the pitfalls of payday loans.

Negotiating with Service Providers:

If you’re struggling to pay your bills or fines, you can contact your service providers immediately. They are often willing to work with you to create a payment plan that suits your financial situation. This can help you avoid the need for a payday loan altogether.

Additionally, some service providers, such as utility companies, offer rebates and vouchers to assist customers facing financial hardship. Exploring these options can help alleviate the burden of unexpected bills and minimise the need for short-term loans.

Non-Conforming Loans:

If you have been rejected for a loan by traditional banks, non-conforming loans may be a viable alternative. Specialised lenders offer these loans to individuals who may not meet the strict criteria set by the banks.

While non-conforming loans may have higher interest rates than conventional ones, they are generally more affordable than payday loans. These loans provide greater flexibility in loan amounts and repayment periods, allowing borrowers to find a repayment plan that suits their financial capabilities.

Debt Consolidation Loans:

Consider looking into debt consolidation loans if you struggle to manage multiple loans, credit card debts, or other financial obligations. This type of loan allows you to combine all your debts into a single loan with a more manageable monthly payment. Streamlining your debts can reduce the stress of multiple repayments and lower your overall interest costs.

Debt consolidation loans are particularly beneficial for individuals caught in a debt cycle caused by high-interest payday loans. By consolidating your debts, you can regain control of your finances and work towards a debt-free future.

Chipkie: Simplifying Family Loans

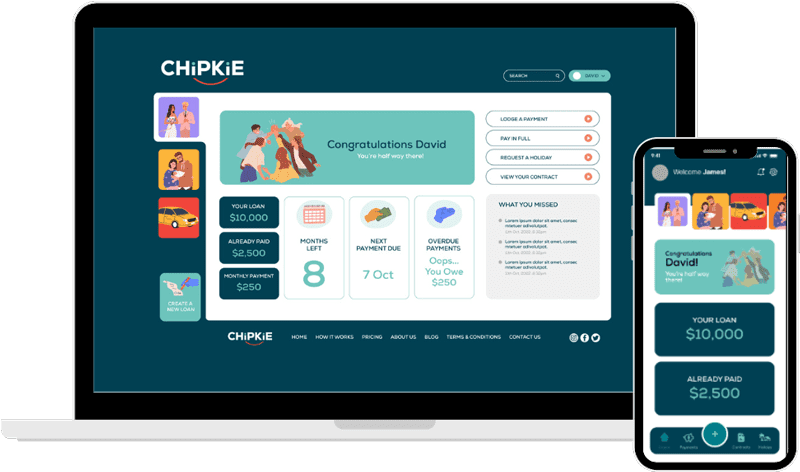

In addition to these alternatives, another innovative solution is emerging in the lending landscape. Chipkie, a leading platform, is revolutionising how individuals lend money to friends and family. Chipkie makes lending money to loved ones hassle-free, safe, and transparent.

Chipkie automates loan terms and payments, giving borrowers and lenders peace of mind. The platform ensures transparency and accountability, eliminating the risks and awkward conversations often associated with informal family loans. Using Chipkie, lenders and borrowers can easily navigate the lending process, fostering stronger relationships and promoting community financial well-being.

At Chipkie, we are committed to improving access to capital and support for needy people. Our platform is designed to simplify finance and provide a reliable, knowledgeable friend to guide you through the lending process. With Chipkie, you can lend money to friends and family without the drama, only good karma.

When faced with financial challenges, exploring safer payday loan alternatives is crucial. No-interest loans, Centrelink advance payments, negotiating with service providers, non-conforming loans, and debt consolidation loans offer viable options for individuals needing financial assistance. These alternatives provide more affordable terms, lower interest rates, and improved repayment options compared to payday loans. Platforms like Chipkie are also transforming the lending landscape by making family loans more accessible and secure. By embracing these alternatives and responsible borrowing practices, Aussies can better handle their finances and build a brighter financial future.

Remember, when it comes to borrowing money, it’s essential to prioritise your financial well-being and choose options that align with your long-term goals. By making informed decisions and exploring alternatives, you can navigate economic challenges without falling into the trap of payday loans.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial advice. We always recommend consulting with a financial professional before making any financial decisions.