Borrowing money can be a stressful experience, but what if there was a way to make it more personal and less intimidating? Many people shy away from asking friends or family for financial help due to potential awkwardness or fear of damaging relationships. However, borrowing money from friends can often be a better alternative to taking out a bank loan. Let’s explore why this might be the case and how Chipkie can make the process smooth and beneficial for everyone involved.

Borrowing Money from Friends: Breaking the Stigma

The stigma surrounding borrowing from friends stems from the fear of jeopardising personal relationships. People worry that money matters can lead to misunderstandings, resentment, or even the end of a friendship. However, with the right approach, borrowing from friends can be a positive experience that strengthens bonds rather than breaking them.

Consider this: when you borrow money from a friend, you’re dealing with someone who genuinely cares about your well-being. They are likely to offer more flexible terms and lower interest rates than a traditional bank. Moreover, the emotional support and understanding you receive from a friend can be invaluable during tough financial times.

The Financial Advantages of Borrowing Money From Friends

One of the biggest advantages of borrowing money from friends is the potential cost savings. Traditional bank loans often come with high-interest rates, rigid repayment schedules, and additional fees that can quickly add up. In contrast, a friend might lend you money with little to no interest, saving you a significant amount in the long run.

For example, imagine you need $5,000 for an unexpected expense. A bank might charge you an interest rate of 10%, resulting in considerable interest payments over the loan term. On the other hand, a friend might lend you the same amount interest-free or at a much lower rate, making it easier to manage your finances and repay the loan.

Flexible Repayment Terms When Borrowing Money From Friends

Another benefit of borrowing from friends is the flexibility in repayment terms. Banks are often strict with their repayment schedules, which can be stressful if you encounter financial difficulties. A friend, however, is more likely to understand your situation and offer a more flexible repayment plan.

Let’s say you borrowed money from a friend and suddenly faced an unexpected expense, such as medical bills or car repairs. Instead of facing penalties or increased interest rates, you could discuss your situation with your friend and adjust the repayment terms accordingly. This flexibility can alleviate a lot of stress and help you navigate financial challenges more effectively.

Strengthening Relationships

Borrowing from friends doesn’t have to strain relationships. In fact, it can strengthen them if handled correctly. Open communication, honesty, and clear agreements are key to ensuring that both parties feel comfortable and respected.

Before borrowing, have an honest conversation with your friend about your needs, repayment plans, and any concerns either of you might have. Draft a simple agreement outlining the loan terms, repayment schedule, and any interest involved. This transparency helps to set clear expectations and avoid misunderstandings.

Safeguarding the Relationship With Chipkie

Borrowing from friends can be a fantastic alternative to bank loans, especially when using a platform like Chipkie. Chipkie simplifies the process, ensuring that both borrowers and lenders feel secure and respected. By providing a structured framework for personal loans, Chipkie helps to maintain transparency and trust between friends.

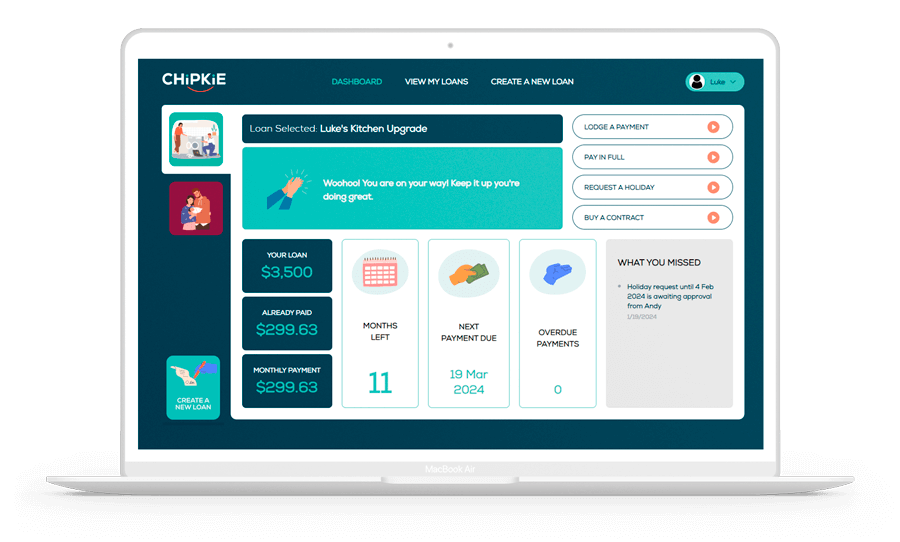

With Chipkie, you can create legally binding agreements that outline the terms of the loan, repayment schedule, and any interest rates involved. This not only provides peace of mind for both parties but also helps to prevent any potential disputes. Additionally, Chipkie offers tools to track repayments and send reminders, making the entire process smooth and stress-free.

For instance, Sarah needed to borrow $3,000 to cover her tuition fees. Instead of approaching a bank, she asked her friend, John, for help. Using Chipkie, they drafted an agreement detailing the loan terms, including a low-interest rate and a flexible repayment plan that suited Sarah’s budget. With Chipkie’s reminders and tracking tools, Sarah was able to repay the loan on time, and their friendship remained strong and intact.

Borrowing from friends can offer numerous benefits over traditional bank loans, including cost savings, flexible repayment terms, and strengthened relationships. By breaking the stigma and approaching the situation with transparency and respect, you can turn a potentially awkward situation into a positive experience.

With Chipkie, borrowing from friends becomes even more advantageous, providing a structured and secure framework that protects both borrowers and lenders. So, the next time you need financial assistance, consider turning to your friends and let Chipkie help you make the process smooth and worry-free.