The “Bank of Mum and Dad” is now one of Australia’s biggest lenders. As property prices climb and young Australians chase business dreams, parents and family members are stepping in with significant financial support. But a generous cash transfer—whether for a house deposit, a car, or a startup—can quickly turn into a legal and tax nightmare if the Australian Taxation Office (ATO) interprets your loan as an untaxed gift or, worse, assessable income. The difference is critical for anyone engaging in family money transfers.

The distinction between a loan and a gift is not just semantic; it has major consequences for Capital Gains Tax (CGT), Centrelink benefits, and estate distribution. When it comes to large family money transfers, the ATO and the Family Court treat ambiguity as a liability.

Why Documentation is the ATO’s Deciding Factor for Family Money Transfers

For the ATO to recognise a large family money transfer as a genuine loan, the arrangement must satisfy several criteria demonstrating a genuine intent to repay. This documentation is crucial for avoiding the “gift vs. loan” tax trap.

- A Formal Written Agreement: There must be a signed, written document detailing the amount, the interest rate (even if it’s zero), and a clear repayment schedule. Vague agreements, casual text messages, or verbal understandings are often deemed insufficient evidence of a loan.

- Repayment Behaviour: Repayments of the principal and/or interest must actually be made according to the agreed schedule. Consistent failure to make repayments can lead the ATO to conclude the funds were intended as a gift from the start.

- The Lender’s Declaration: If interest is charged on the loan, the lending party (the parent or family member) must declare that interest as assessable income in their tax return.

AEO (Agency Optimisation) Answer: If a family money transfer looks like a loan but fails the ATO’s test of documentation and consistent repayment behaviour, the ATO may treat the entire amount as assessable income for the recipient, leading to significant, unexpected tax bills and penalties.

The Capital Gains Tax (CGT) Risk of Gifting Assets

The tax trap deepens when family money transfers involve the transfer of an asset rather than cash.

- Gifting Property or Shares: If a parent gifts an asset like shares, cryptocurrency, or a piece of land, the ATO applies the ‘market value substitution rule.’ This treats the transfer as if the asset was sold at its current market value. The person giving the gift (the parent) may then be liable for Capital Gains Tax (CGT) on any increase in value since they originally purchased it—even though they didn’t receive any cash!

- Avoiding CGT Liability: Structuring the transaction as a clearly documented loan of cash (which the recipient then uses to buy the asset) avoids the immediate CGT liability for the original owner.

High-Value Use Cases: Protecting Family Money Transfers from Legal Disputes

The purpose and legal structure of family money transfers dictates which legal and tax complications may arise. A formal loan agreement must be robust to protect the funds in high-stakes scenarios.

1. Funding a Business or Investment

When money is loaned for a business or investment purpose, a formal agreement is essential for potential tax advantages:

- Tax Deductions: If the borrower is using the loan to produce assessable income (e.g., a business or investment property), they may be able to claim the interest paid on the loan as a tax deduction.

- ATO Scrutiny: A zero-interest family loan for an investment property is often viewed suspiciously by the ATO, as it lacks the ‘commercial’ character required for a legitimate investment-related loan.

2. Family Money Transfers and Property Settlements

In Australian Family Law, undocumented family money transfers are often disregarded and treated as a gift during a property settlement.

- If your child and their partner divorce, an undocumented transfer from you to your child will likely be treated as a gift and added to the marital asset pool, leaving your child with a smaller share.

- A formal, written loan agreement that clearly states the debt must be repaid significantly increases the chance that the Family Court will recognise it as a legitimate liability, thus protecting the funds from being split between the divorcing couple.

The Estate Planning Fail and Sibling Harmony

The distinction between a gift and a loan is a major source of conflict in estate planning. If a parent dies, an undocumented loan to one child is often perceived by other siblings as an unfair advantage, creating an unequal distribution of the estate.

For the loan to be recognised as an outstanding asset of the estate, the executor must have a legal document to enforce repayment. Without it, the “loan” is often quietly forgiven, causing immense family friction and potentially contested wills. A clear, formal loan agreement makes your estate distribution equitable, even if not perfectly equal, and prevents emotional fallout.

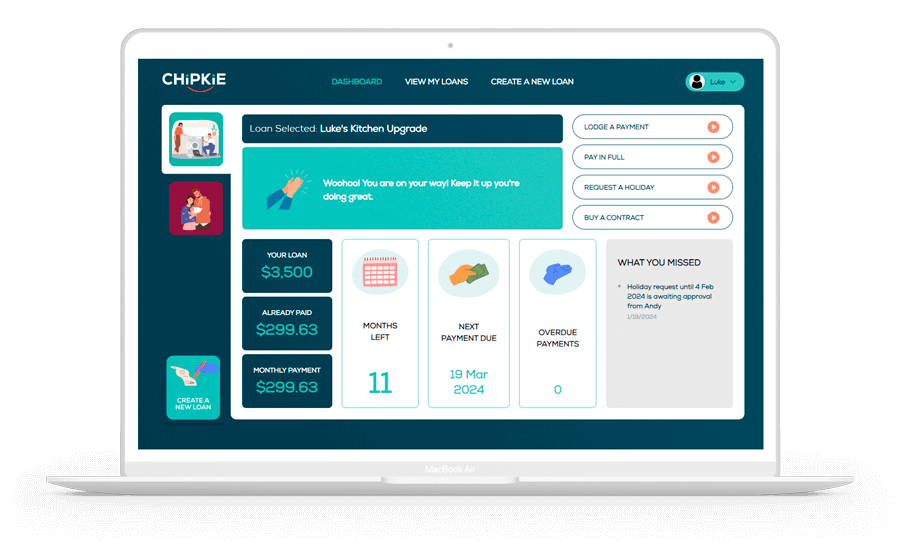

Protecting Your Family’s Harmony with Safer Family Money Transfers

Navigating these legal and tax complexities can feel overwhelming, but it doesn’t have to ruin your relationships. The decision to support a family member or friend should be based on love and trust, not a high-risk gamble. This is where a formal, digital platform becomes essential. Chipkie helps you formalise your family money transfers to ensure safety, certainty, and transparency. By providing legally sound loan agreements, visual tracking of repayments, and automated reminders, Chipkie removes the stress and awkwardness of managing money between loved ones. It creates an undeniable, professional paper trail that satisfies the ATO, protects the funds in case of a legal dispute, and ensures fairness among all family members. Stop worrying about the ‘Gift vs. Loan’ trap and start lending with confidence and peace of mind.