Are you considering using personal loans to pay off credit card debt? More and more people are switching to personal loans for various reasons – from purchasing a new car, to covering medical expenses. However, one of the more common reasons is to pay off credit card debt. A personal loan can replace multiple high-interest credit card payments with a single, lower-cost and often zero-interest monthly loan repayment.

Comparing Personal Loans and Credit Card Debt:

When considering using personal loans to pay off credit card debt, its important to fully understand the disctinction. Both credit card and personal loan debts represent outstanding balances. However, the cost associated with each can differ. Credit cards usually have interest rates ranging from 12% to 30%, while personal loans generally offer rates between 3% and 20% (and sometimes zero, depending on the relationship between lender and borrower). This difference often makes personal loans a more cost-effective choice for managing debt.

Top 4 Advantages of Using Personal Loans to Pay Off Credit Card Debt

- Lower Interest Rates: Credit cards can have interest rates upwards of 20-30%. In comparison, personal loans usually offer average rates below 10% due to the personal nature of the relationship between the parties.

- Simplified Payment Process: Juggling multiple credit card payments can be challenging. Consolidating them into a single personal loan payment can make managing your finances easier and reduce the risk of missed payments.

- Positive Impact on Credit Score: By paying off your credit card balances, you reduce your credit utilisation, improving your overall credit card score. By taking a personal loan, you also lower your risk of having a bad credit score due to late payments.

- Accelerated Debt Clearance: Relying solely on minimum credit card payments can prolong your debt for years. With a personal loan, you can immediately clear your credit card debt and establish a structured repayment plan, potentially shortening your debt timeline.

Three Considerations Before Using Personal Loans to Pay Off Credit Card Debt

Before using personal loans to pay off credit card debt, consider the following:

- Risk of Accumulating More Debt: Securing a personal loan consolidates all loans into one lump sum. If you start accumulating balances on your credit cards again, you’ll end up with more debt than you began with. Therefore it is essential to close off the cards once the debt is paid.

- No Guarantee of Lower Rates: While personal loans often offer low and even no-interest rates based on the relationship, there is no guarantee. Some lenders may choose to offer higher interested rates, so its important to enter conversations with an open mind.

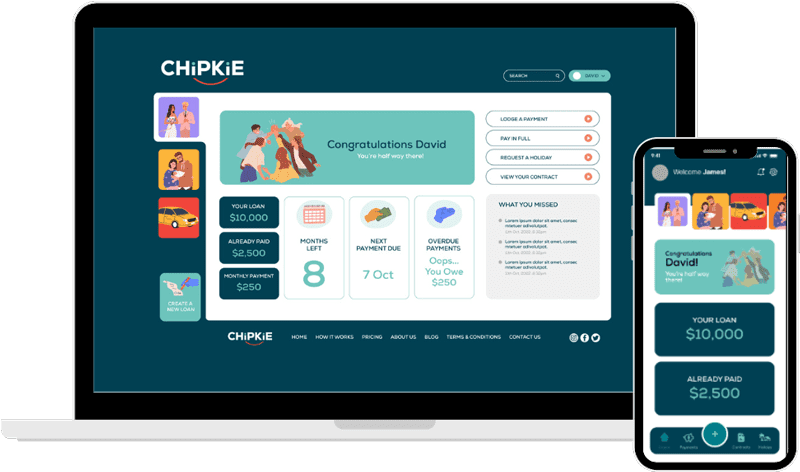

- Potential Risk to the Relationship: As personal loans are between friends and family, it is a risk that if things don’t go according to plan and payments are missed, that it could sour the relationship. Using a tool like Chipkie to help manage and track repayments; formalise communication; and lower the risk to the relationship.

Steps to Secure a Personal Loan for Debt Consolidation

First and foremost, it’s necessary to do the proper diligence and evaluate all your loans. You’ll need to understand what’s required to make a full repayment and what the loan repayments would be if you were to consolidate and move to a personal loan. From there, it’s necessary to understand what you can afford as part of a monthly repayment, what interest rates you could accommodate if the lender chooses to pursue this, and how long you would need to make repayments.

Asking for a personal loan can be a nerve-wracking experience, especially in the lead-up when you are unsure how they will respond. That’s why we have prepared a helpful guide on the best psychological tips for requesting money from friends and family. With the proper preparation you can have a successful conversation that doesn’t stress the relationship and makes the

The Power of Low-Interest Personal Loans in Debt Management

One of the most strategic moves in financial management is using personal loans with lower interest rates to clear off high-interest credit card debts. This approach streamlines your debts and significantly reduces the amount you’d pay in interest over time. While there are various sources for personal loans, the most affordable rates often come from those closest to us: friends and family loans. However, borrowing from loved ones can sometimes be fraught with tension due to the potential risks and uncomfortable discussions about money.

At Chipkie, the focus is on fostering community growth by simplifying the process of lending money within personal networks. Recognising that while many of us lend to friends and family up to five times annually, only a small fraction feel confident about it. The platform addresses the typical challenges associated with such loans, ensuring both parties have peace of mind. With Chipkie, lending within your circle becomes easy, secure, and devoid of awkwardness, making it the ideal choice for managing personal loans. If you are ready to consolidate your credit card debt and request a personal loan, Chipkie is a great solution to offer peace of mind and keep your relationship strong. Try it today.