In personal finance, Jack and Emma, a fictional couple in their late twenties, are considering seeking financial support from their parents, Alan and Sarah, known affectionately as the “Bank of Mum and Dad.” Let’s delve into their potential journey, highlighting pros and cons of using the Bank of Mum and Dad.

Pros of Using the Bank of Mum and Dad:

- Lower Interest Rates: Jack and Emma are eager to buy their first home but find traditional mortgage rates daunting. Mum & Dad step in, offering a loan for the down payment with zero interest. This significant financial benefit allows the couple to save thousands of dollars over the life of their mortgage, making homeownership more affordable.

- Flexible Repayment Terms: Understanding the couple’s financial constraints, Mum & Dad agree on a flexible repayment schedule. Jack and Emma can adjust their payments based on their current economic situation, reducing stress and enabling them to manage their finances more effectively. This flexibility is something they couldn’t have found with a traditional lender.

- Emotional Support: Beyond financial aid, Mum & Dad provide invaluable emotional support to Jack and Emma during the stressful process of purchasing a home. Their guidance and encouragement help the couple navigate the complexities of real estate transactions, offering reassurance and bolstering their confidence during uncertain times.

- No Credit Checks: Jack recently graduated and hasn’t had time to build a solid credit history. Borrowing from his parents means skipping the rigorous credit checks required by banks, allowing the couple to secure the loan they need without the added stress of credit scrutiny.

Cons of Using the Bank of Mum and Dad:

- Risk to the Relationships: Despite the initial agreement, tensions may arise if Jack and Emma face unexpected financial difficulties, causing delays in repayment. Mum & Dad, who had expected timely repayments, start to feel uneasy as it is holding them back from their own plans. This strain begins to affect family gatherings, with an undercurrent of financial stress overshadowing their previously harmonious relationship.

- Risk on Inheritance to Other Children: Mum & Dad’s decision to lend a significant sum to Jack and Emma can put the inheritance to other children of the family at risk. If the loan is not paid back prior to Mum & Dad becoming deceased, the total inheritance pool will effect the other children.

- Impact on Retirement Plans: Mum & Dad have carefully saved for their retirement, planning for a comfortable future. By lending a large sum to Jack and Emma, they may have redirected funds from their retirement savings. This decision forces them to reassess their financial plans, potentially delaying their retirement or altering their lifestyle expectations.

- Risk of not being paid back in time: Without clear documentation and legal agreements, the informal loan arrangement becomes a source of confusion. Jack and Emma aren’t always on the same page with Mum & Dad in regards to when the loan is meant to be repaid and they believe that they have a longer window to pay back the loan than they do.

Navigating the complexities of the Bank of Mum and Dad requires open communication, mutual respect, and careful consideration of both the financial benefits and potential pitfalls. For Jack, Emma, and many others, weighing these factors ensures informed decision-making, fostering financial stability while preserving cherished family relationships.

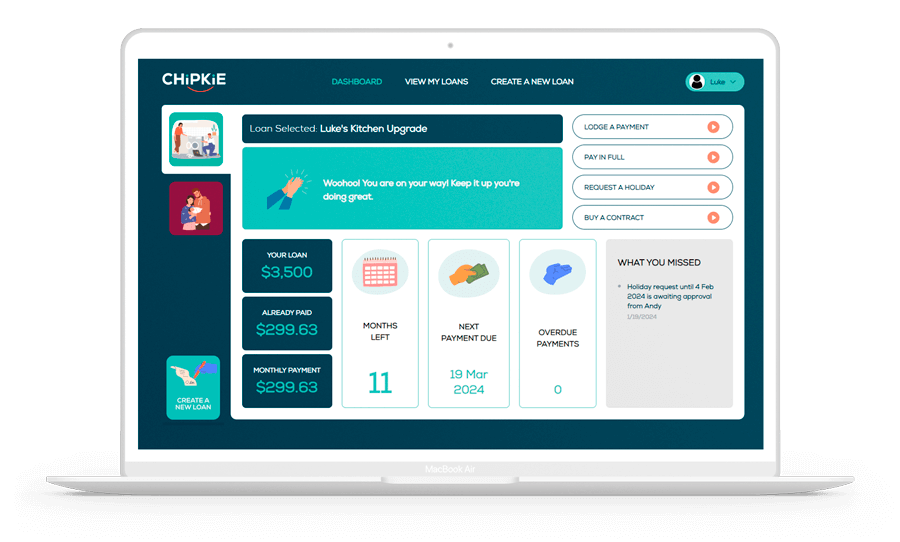

As personal finance landscapes evolve, understanding these dynamics empowers individuals to make prudent financial choices aligned with their long-term goals. By approaching the Bank of Mum and Dad with clear agreements and mutual understanding, families can support each other effectively, maintaining both financial health and family harmony. And using a tool like Chipkie to help legalise, manage and track the loan can be a useful way to minimise the risks listed above.